How Do I Know If I Have Gap Insurance? (Updated 2023)

Table of Contents Most insurance policyholders pay little heed to their insurance policy’s coverages, deductibles, and terms and conditions. As a result, many are unsure

You have heard of Univista Insurance but are not sure about their offerings? Need to learn about their policies and coverage?

This article explores all aspects of Univista Insurance in detail and thoroughly scrutinizes all the policies that would help you make an informed and knowledgeable decision.

UniVista Insurance is an independent insurance company owned and operated by a family. The company is managed by Ivan Herrera and his wife, Ania Herrera.

This franchisor of insurance products and services has been a part of the insurance industry and offering these services to the residents of Florida for more than a decade now.

Its mission statement indicates that its main focus is to provide insurance that provides the most innovative solutions to its customers, covering them in every possible situation but is affordable at the same time.

Their family values are reflected in the insurance company as well as they want to reflect their sense of customer loyalty, build strong relationships, and promote professional growth, being a positive influence in the insurance community.

They have become a trusted leader in the Florida insurance space with the help of their wide-ranging quality coverages offering quality protection, superior customer service, and, most importantly, the lowest rates in Florida.

Owing to their exceptional success in Florida, they have expanded to California, thus offering their amazing products and services to both the East and West Coast.

Their product line includes home, auto, business, and health insurance. They are currently available in 151 locations in South Florida, with over 10 corporate offices, 141 franchises, and three call centers.

In 2020, Insurance Journal ranked them among the top 26 property and casualty insurance providers. The insurance platform also ranked 2710 in the list of 5000 fastest-growing private companies in America.

Company Name | UniVista Insurance |

Founder & CEO | Ivan Herrera |

Year Founded | 2009 |

Headquarters | Miami, Florida, USA |

Number of Employees | 1210 |

P\C Revenue: $130,254,825 Other Revenue: $22,288,139 | |

Website |

UniVista Insurance is a full-service insurance agency offering insurance products and services in different domains.

The types of Insurance offered by UniVista are as follows:

UniVista Insurance offers a wide range of coverages with its vehicle insurance. It offers Auto and Motorcycle Insurance as part of its vehicle insurance offerings.

UniVista’s Auto Insurance helps customers find the best-suited affordable car insurance for their cars in Florida, California, and Texas.

Are you facing a ticket for an accident, have a DUI, need SR-22 or FR-44 coverage, or need something else? A dedicated agent can help you get the best insurance for your car as per your need within an affordable budget.

The question may often arise in your mind why do you need an auto insurance policy, and why do you need to keep paying the premium?

Although it’s unfortunate, accidents are a reality, and they do happen. If you don’t have proper auto insurance, it may cost you a lot of money post-accident. Insurance makes sure you are well protected so that you can ride peacefully.

Auto insurance provides the following:

With the help of PIP, which is mandatory for owners of four-wheelers or more wheels, you don’t need to sue for any reimbursements, medical expenses, or any other bills that may be incurred as a result of an accident, and you can claim coverage as per your coverage limits.

Suppose you had caused any physical injury to another person when you met with a car accident. In that case, you don’t need to worry about being sued as the Bodily Injury Liability coverages for auto protects you from the injured person’s associated medical expenses, lost wages, pain, and suffering.

Suppose you have caused any damage to another person’s property, including fences, telephone poles, buildings, and cars. In that case, the Property Damage Liability coverage offers protection against the cost of the damages. It is even applicable if you are driving a car not owned by you.

If your car is damaged due to a collision with any object, then the Collision coverage protects your car from it. Comprehensive coverage protects your car from any other damage that is not a collision.

A lot of factors, such as driving history, vehicle model, zip code, etc., are considered to calculate the cost of auto insurance by UniVista. However, UniVista does put a lot of emphasis on availing as many discounts as possible to the interested party as they are focused on building a long-term relationship and potential reference to other customers.

The discounts provided by UniVista to lower the cost of Auto Insurance are as follows:

The name, date of birth, license number, and other relevant information for each driver and the name and date of birth of all household members are required.

The car’s Year, Make, Model, and VIN or Vehicle Identification Number are required.

If applicable, the most recent insurer’s information may also be required.

UniVista offers affordable and customizable motorcycle insurance for your motorcycle, be it a classic or a sports bike that needs to be insured.

In general, the same coverages as Auto Insurance is offered, only there are some additional discounts.

The documents needed are the same as auto insurance, as mentioned above. It needs the following motorcycle details – Make, Model, and VIN.

Home is usually one of the most expensive investments a person may make. Hence, protecting that prized possession is an important decision a person needs to take.

UniVista Homeowners Insurance protects your homes against anything that may cause damage to your home at the lowest insurance rates. It may be an unfortunate event like fire, hurricane, or vandalism, but the home insurance from Univista protects from all such incidents.

Homeowner Insurance Coverage

Homeowner Insurance offers protection against natural calamities like a hurricane, unfortunate events like a fire, or a case of vandalism. As UniVista values customer loyalty, they offer extremely competitive cost options for insuring your home. The insurance provides coverage at the present replacement value, which ensures that the insured incurs no loss.

Purchasing homeowner insurance from a reputed insurance agency is always advisable. UniVista makes it a point to make qualified, specialized agents ready to take care of your insurance needs regarding your home, offering the most affordable price and customizing the needs simultaneously.

Let’s check all the home insurance coverages provided by UniVista:

The HO3 offers extensive coverage for your home, personal property, and liability protection and is one of the most common home insurances sold across the United States.

If you need protection for the interior walls of your condo or townhouse and personal property and liability protection, then go for the HO6, the most common policy for insuring condos and townhouses across the United States.

The HO4, also called Renters Insurance, offers great coverage for personal property and liability protection if you rent a home, condominium, townhouse, or rental apartment.

DP3 is one of the three most commonly insured policies in the United States for rental properties. It gained popularity owing to its Open Peril policy and also because it is more comprehensive than DP1 or DP2.

If a bodily injury occurs to anybody or property damage is caused to others, whether inside or outside the home, then the Home Liability Insurance offers personal liability coverage against the costs associated with such accidents.

When a flood happens, the rising water, mold, and mudslides may cause direct damage to your home, other places of dwelling, interior and exterior walls, roofs, furniture, clothes, and appliances. Flood Insurance offers protection against such damages. However, it must be noted that it is not a covered peril under a homeowner policy and needs to be purchased separately or added to your policy by endorsement (if available).

Commercial businesses are the backbone of the success of the USA. Hence, businesses must protect their most prized asset, i.e., their employees. The employer must protect its employees and the company simultaneously in case it faces a lawsuit for some mishaps.

UniVista’s Commercial or Business Insurance offers extensive business coverage, including property, assets, and employees.

The coverages provided by Commercial Insurance are as follows:

If your employees cause injury to others or property belonging to others, then Commercial Auto Insurance covers those injuries and protects you, your worker, and the vehicle(s).

A BOP combines multiple coverages, including additional protection, all bundled into a single package. You can contact the agent to discuss the detailed coverages you need, and the agent will include that coverage in your policy to suit your requirements.

If an employee is injured, needs time off from work, and needs help paying the medical costs and lost wages, then the Workers’ Compensation coverage will offer that protection.

Basic property insurance covers damages caused by fire, natural calamity, or vandalism. With the help of Commercial Property Insurance, further coverages for earthquakes and glass breakage can be added.

Other office buildings, inventory, outdoor items, and equipment can also be covered with this coverage. UniVista offers a Commercial Package Policy(CPP) customizable to suit your needs that will cover all the damages related to an office.

It covers all the basic coverages offered in Business Liability Insurance. Contacting an agent will further help you understand what is and is not covered in the policy.

Data breach is a reality these days as more and more computer attacks are becoming prevalent. If your business becomes a victim of a computer attack, then this coverage prevents you from damages from a financial and reputational standpoint.

If your business becomes a victim of burglary, robbery, forgery, computer fraud, employee dishonesty, and other crimes, then Crime Insurance covers them and offers you protection.

Suppose an unfortunate situation arises where you have to shut down your business temporarily owing to a covered loss. In that case, the Business Income coverage helps you cover payroll, pay relocation expenses, and replace lost income.

A business may face a situation where they cannot collect payment from a customer, which affects the accounts receivable records. This coverage helps your business with protection against that situation.

Suppose your business faces losses against equipment failures, including mechanical malfunctions, power surges, operator error, and any associated losses. In that case, the Equipment Breakdown coverage helps your business with protection against those losses.

If your fine artwork, computer equipment, data, or any other property is in transit, the Inland Marine coverage protects your property.

Every construction project needs protection throughout the different stages, and this coverage does exactly that.

Employees may often file lawsuits regarding alleged discrimination, wrongful termination, and harassment. The EPL coverage offers protection against these lawsuits or any other employment-related issues.

If any client sues your business regarding alleged negligent acts, errors, or omissions, then the E&O liability coverage offers protection against such lawsuits to you, your employees, and your sub-contractors.

It has been observed that Florida and California offer very expensive life insurance, which is why many people in these two states do not have any life insurance policies.

However, UniVista wants to change this situation by offering life insurance offerings customized to cater to the client’s needs and will also not burn a hole in your back pocket.

UniVista offers diversified term life insurance packages that are suited to your requirements. Their life insurance includes permanent protection with premiums that would never increase and remain the same from Day 1. Furthermore, it also provides for your family in your absence.

Suppose you have a chronic illness, critical illness, or terminal illness. In that case, the Living Benefits can offer much-needed financial security to your loved ones, including death benefits when you and your family need it the most.

A college education is an expensive affair that needs prior planning so that you can offer the best education possible to your children or loved ones. The College Planning coverage can secure you financially by covering the college fees as part of the life insurance policy.

In most people’s lives, a house is their biggest investment. So, it is extremely important to protect your family and your home with proper protection. If an unfortunate event of your death arises, then the Mortgage Protection coverage can protect your home by paying the mortgage in full and making your home free of any debt.

It is important to secure your future as Social Security and savings may not always be necessary to lead a peaceful and relatively lavish life after retirement. Sometimes, an additional income is necessary even to cover the basic costs. Retirement Planning coverage covers that problem and ensures a smooth and enjoyable retired life.

The most affordable health insurance available to all sections of society in the United States is Obamacare. It is offered through the marketplace.

The marketplace is the only legal way to obtain Obamacare where you can qualify for a govt based on your family income.

It offers a subsidy, where you need to pay the minimum premium for this health insurance covering everything from doctor visits, specialists, labs, outpatient surgeries or any type of hospitalization, medical emergencies, and emergency rooms.

UniVista Insurance has numerous licensed agents who are technically savvy and can guide you in obtaining the best possible subsidy as per the size of your family and income level. They ensure you pay the lowest price possible as the premium and customize the plan according to your needs.

They also offer Medicare Advantage Plans, which offer normal health insurance suited to your health needs and doctor requirements.

The drawbacks of UniVista Insurance are as follows:

According to Zoominfo research, the top competitors of UniVista Insurance are as follows:

| Competitor Name | Revenue | Number of Employees | |

|---|---|---|---|

| #1 | HealthMarkets Insurance Agency | $2.8 billion | 2145 |

| #2 | Auto Insurance Specialists LLC | $247.5 million | 790 |

| #3 | Cumberland Insurance Agency | $15.2 million | 143 |

| #4 | Fin Svcs Inc. | $30.8 million | 138 |

| #5 | Shaffer Insurance Services Inc. | $6.8 million | 136 |

| #6 | Garner D Jensen Insurance Group | $32.6 million | 126 |

According to Growjo research, the top competitors of UniVista Insurance are as follows:

| Competitor Name | Revenue | Number of Employees | Employee Growth | |

|---|---|---|---|---|

| 1. | SUNZ Insurance Company | $34.4M | 142 | 7% |

| 2 | Specialty Group | $11.9M | 60 | -2% |

| 3 | Brier Grieves Insurance | $3.7M | 29 | 12% |

| 4 | Peachtree Special Risk Brokers | $38.5M | 159 | 6% |

| 5 | PrimeGroup Insurance | $4.3M | 34 | -3% |

| 6 | Gridiron Insurance Underwriters | $3.5M | 28 | 22% |

| 7 | Insurance Risk Services | $25.5M | 142 | 23% |

| 8 | Carolina Casualty Insurance Company | $21.1M | 96 | 8% |

| 9 | HH Insurance | $3.5M | 28 | 87% |

| 10 | A1HR | $16.7M | 93 | N/A |

Follow the Steps:

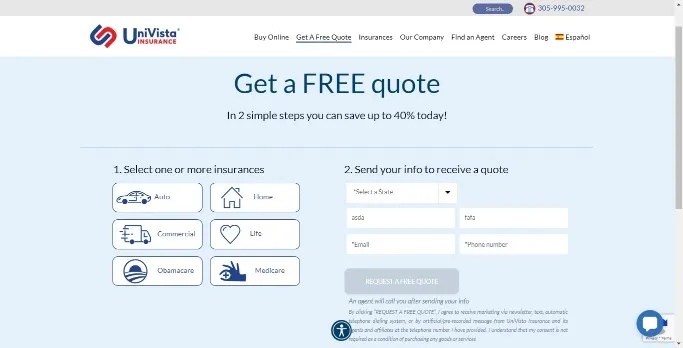

1. To get a UniVista Insurance Quote, go to the UniVista Home page and click on the “Get a Free Quote” button on the Get a Free Quote box on the top left or click the “Get a Free Quote” button on the menu.

2. Select the Type of Insurance from the following options (You can select more than one)

3. As the Quotation page loads, enter the following data.

4. Once the information is filled in, click “Request a Free Quote” and complete the process.

Tip: Alternatively, call 305-995-0032 and talk to an agent for a free quote.

Note: Once the process is complete, a “Thank You” page loads and informs that an agent will connect with you soon.

Only Florida residents can buy UniVista Insurance Online.

You can use the UniVista app to manage your account, pay the premiums, and check your payment history.

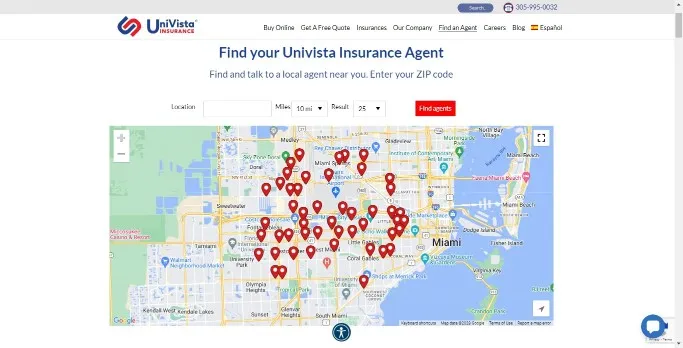

You can visit UniVista’s Find an Agent page, enter the Location, and click “Find Agents ” to show the agents within a 10-mile radius. (You can change the number of agents to be shown the radius).

Phone: (239) 317-6869

Fax: (239) 317-6960

Email: [email protected]

Agency Hours:

Mon – Fri: 9:00am – 6:00pm

Sat: 10:00 am – 2:00 pm

Tip: You can also chat with them by clicking on the chat icon present on each page of the UniVista website.

Obama Health Care Contact Number:

Phone: (305) 964-8803

Medical Advantage Plan:

Phone: (305) 257-9989

You can also visit the “Contact” page, fill out the form, and click “Send Message” to send a query which will be responded to asap.

You can also visit the “Contact My Carrier” page to get hold of your Carrier’s contact number.

The owner of UniVista Insurance is the Herrera family, headed by Ivan Herrera and his wife, Ania Herrera.

According to UniVista’s About Us page, they have about 1210 employees working for them at present.

According to Insurance Journal, UniVista’s latest Total Annual Revenue is $152,542,964, with P\C Revenue as $130,254,825 and Other Revenue as $22,288,139.

Read More:

Univista Insurance offers a wide range of insurance in different domains in partnership with many insurance companies for certain insurances. They are a young, family-owned insurance company; its strong point is its focus on family values and healthy client relationships.

They have a strong customer base in the Hispanic community in Florida. Hence the company focuses on the Hispanic market outside of Florida.

Although they are only present in a handful of states and have a lot of room to grow and improve their services, their focus on reaching out to the customer and offering affordable and customized insurance policies as per the need of the customer has already showered them with unprecedented success and will also take them a long way.

If you Live in the states where they serve, like Florida, California, etc., and you are also looking to get an insurance policy but don’t have an extensive budget but need overall good coverage, then UniVista may be a good choice.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Univista or its partners. The product information may vary. Please check the issuer’s website for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any insurance issuer. The content is for informational purposes only. It is not financial advice.

Share this post:

Table of Contents Most insurance policyholders pay little heed to their insurance policy’s coverages, deductibles, and terms and conditions. As a result, many are unsure

Table of Contents Insurance is an integral part of our modern life, and homeowners insurance is one of the most important insurances that have become

Table of Contents I interviewed an experienced insurance agent from a reputed global insurance company who pointed out why many young insurance agents leave their