How Do I Know If I Have Gap Insurance? (Updated 2023)

Table of Contents Most insurance policyholders pay little heed to their insurance policy’s coverages, deductibles, and terms and conditions. As a result, many are unsure

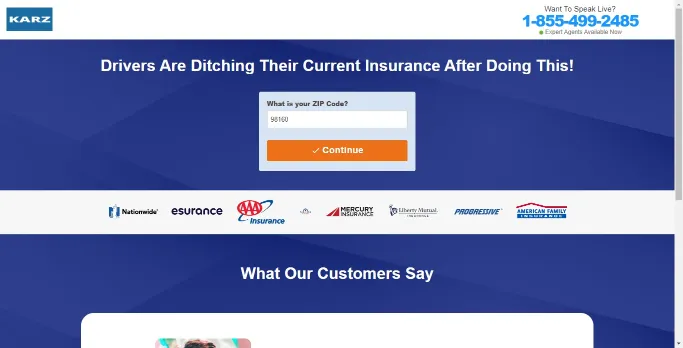

Want good insurance for your vehicle? You have heard about Karz Insurance but are still determining whether it is the best fit for you and want to know more about it in detail.

We did a rigorous analysis of all aspects of Karz Insurance to present you with all the details to help you decide whether you should go for it.

Karz Insurance is a Florida-based premium insurance aggregator that provides insurance referral services by collecting information from customers and connecting them to the appropriate insurance companies based on the information, making the buying experience seamless and effortless for the clients.

They connect them to the advertisers and the best local agencies and pass on the collected information to those agencies so that they can offer the best premium rates for your car based on that information and send you free quotes instantly.

However, Karz Insurance is not an insurance company that offers no insurance plans directly to the clients. They are also not representative of any specific insurance company.

They are like a concierge service for auto insurance that acts as a middle-man between the insurance companies and the clients, making connecting them smooth and easy.

However, they focus on providing excellent customer service and a smooth buying experience. So they tune their suggestions according to the customer’s needs and not the other way round.

Note: One should note that the premium may be available at an affordable price but not the lowest rate in the market. The premium prices shown are the most competitive, calculated based on factors such as coverage limits, clean driving record, experience, driving habits, vehicle type, location, home ownership, credit score, etc.

For Example: Following the Insurance Industry trends, classic car insurance or Sports car insurance would cost much more than standard car insurance, or auto insurance for a teenager will cost more than for a 40-Year old driver with a family as teenagers are considered high-risk drivers.

A physical office and an official telephone number are vital for any legit company, and Karz Insurance has both.

They are a service company that does the hard work for the customers to scan through the multiple insurance companies and then offer the best suggestion based on the information collected and connect them to the appropriate insurance contract supplier.

They also have proper Privacy Policy and Privacy Rights documentation where they disclose how they use client information. Moreover, they have garnered many positive reviews and customer satisfaction ratings on BBB (Better Business Bureau) forums and Reddit.

They have not been identified as a scam, and no one has accused them of participating in any fraudulent activities. Moreover, they are not an underwriter of insurance products, or they are not settlers of claims. Their services only include suggestions, and they don’t try to force you to buy any of the suggested products and services.

So, based on all the information, the verdict is that Karz Insurance is legit.

Karz Insurance Company is a tech company with its base camp in Miami Beach, Florida.

A group of tech members runs them spread across the United States that use the power of technology to scan the auto insurance industry, collate multiple insurance companies offering details in their server, and then collect customer information and run them through the server to match with all the stored information from insurance companies.

Their primary focus is to open up avenues of customer access to the best insurance options who do not have the time to conduct thorough research. Hence, after collecting the customer data, it is processed and matched with insurance companies in the database.

Once the matching process is complete, the auto insurers, considered the best choice for drivers based on the level of protection the drivers opted for, are displayed on the screen.

The customers can then take action, i.e., either get the quote and buy it or just consume it as information and do nothing.

Let us look at some of the benefits of Karz Auto Insurance

The most challenging part about choosing good auto insurance for your car is researching it and spending hours of your valuable time finding out about its offerings and coverages. Karz car insurance eradicates that problem. You can now get multiple quotes from the most reputable and quality insurance companies as per your need and the location where you are situated.

Based on the information collected, Karz Insurance offers you the best option for your car. You can now quickly analyze these insurance companies and their premium rates, evaluate their policies and choose the ones that match your coverage requirements and fit your budget. It usually gives suggestions that would benefit auto insurance policyholders.

It is essential to understand your location, as different states have different insurance coverage requirements. So, along with the giants, it is also essential to access local insurance providers. Karz Insurance makes it a point to suggest local providers based on your information and local needs, as sometimes they offer very competitive premium rates with a wide variety of coverages.

When you use Karz Insurance, you are not obligated or committed to buying the insurance after getting the suggested quotes from insurance providers. It is a free-to-use service that gives access to insurance companies and their related quotes. According to their internal matching algorithm, it best reflects your need and requirement for adequate insurance coverage.

Apart from the online process to provide information and get multiple options for affordable car insurance companies and then subsequently the quotes for your vehicle, you can also connect with professional consultants directly via phone who offers expert advice regarding auto insurance that includes all your required coverages and also matches your budget at the same time.

Let us look at some of the drawbacks of Karz Auto Insurance

There are hundreds of options for auto insurance. Still, Karz Insurance has the information of a limited number of Insurance companies, so you don’t get the full-fledged varied offerings. Companies in the market might offer better and more affordable car insurance policies.

Since the offers and the auto insurance coverage options are given based on the Insurance Company information that is available with Karz, there may be other better offers in the market offering better coverage and even giving auto insurance discounts. They also disclose this on the website.

Although researching is a daunting task, it has its positives. When you research, you know what you are looking for, but in Karz Insurance, you only provide the basic info. Then they suggest a few insurance companies which may or may not cover the coverages you are looking for, and then you are back to square one and conduct the research anyway.

Since they are an aggregator rather than a licensed insurance producer, it often creates doubt in the clients’ minds about their legitimacy and what they do.

One can get a quote from the website or the mobile app. A test subject was selected to check the process of getting a quote from Karz Insurance.

The Steps are as follows:

Step 1: Go to the Karz Insurance homepage, enter the zip code in the “What is your Zip Code” box, and click “Continue.”

Step 2: Enter the year of registration of your vehicle.

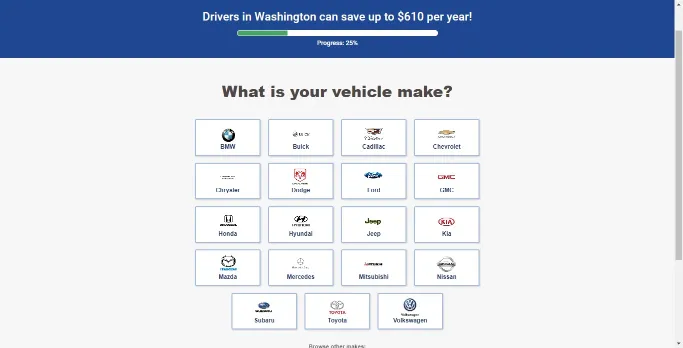

Step 3: Select the make of your vehicle.

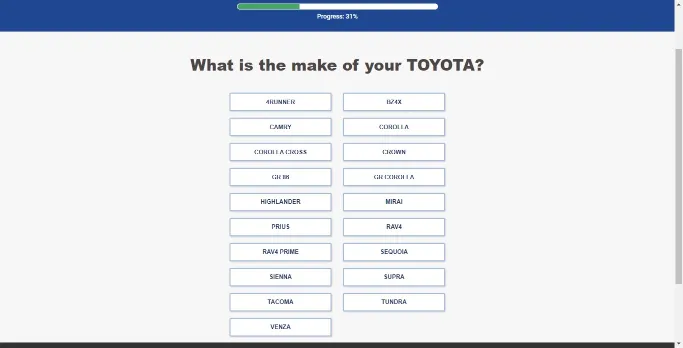

Step 4: Select the model of your Selected Make.

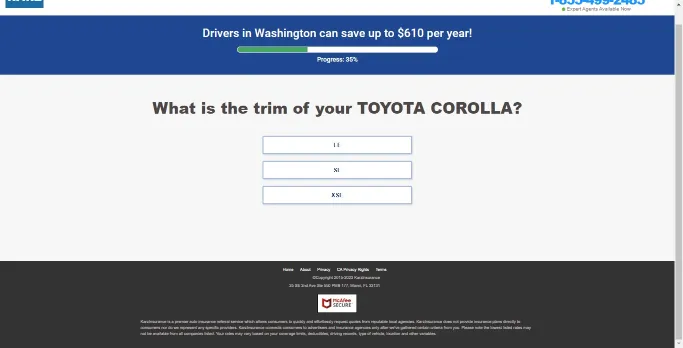

Step 5: Select the specific model of your vehicle (This is model specific)

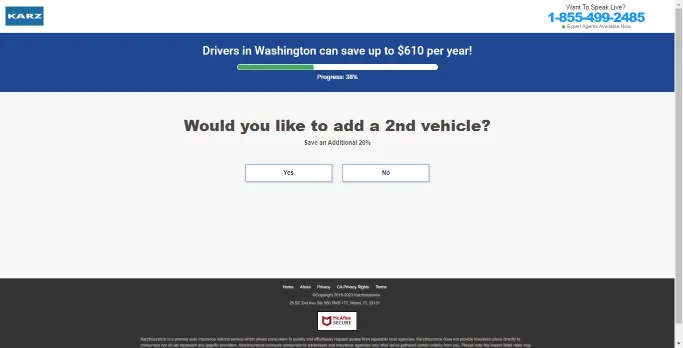

Step 6: Select “Yes” or “No” to the question if you want to add a 2nd vehicle for insurance.

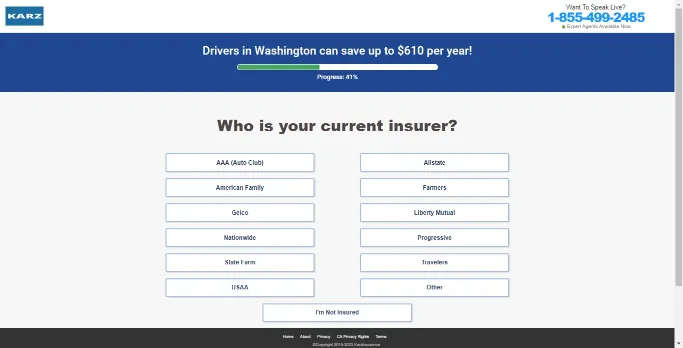

Step 7: If you are insured, then select your current insurer. If not, then select “I’m not insured.”

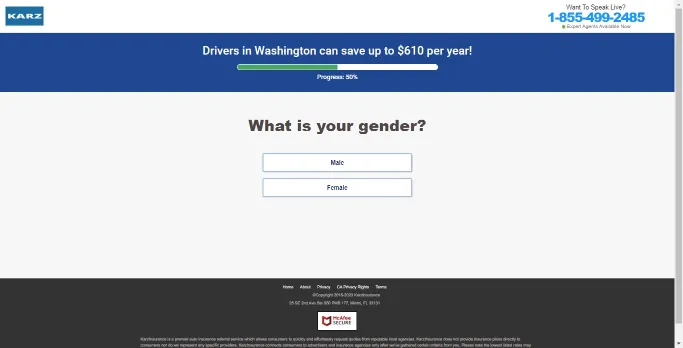

Step 8: Select your Gender

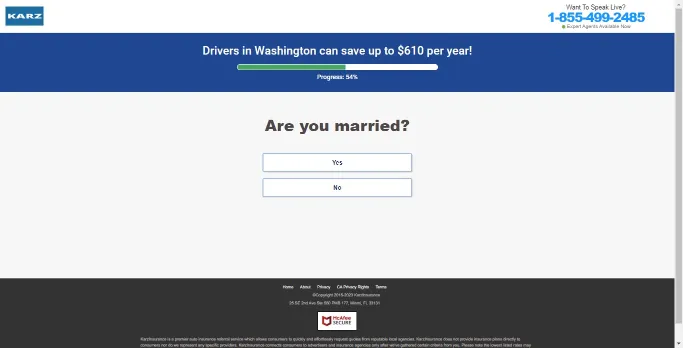

Step 9: Answer “Yes” or “No if you are married.

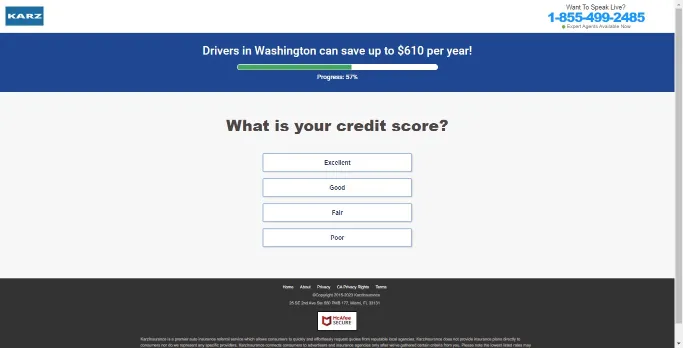

Step 10: Select your Credit Score level.

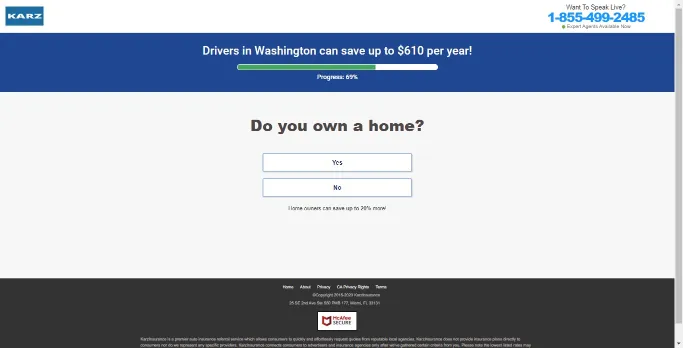

Step 11: Answer “Yes” or “No if you own a home.

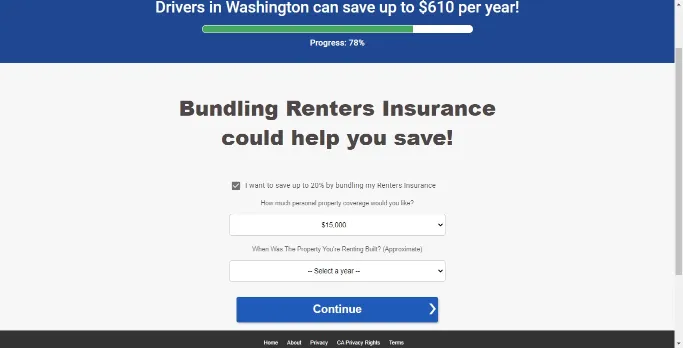

Step 12: Select the option if you want to bundle a Renters Insurance with Auto Insurance (This was shown as “No” was answered to the question “Do you own a home?”)

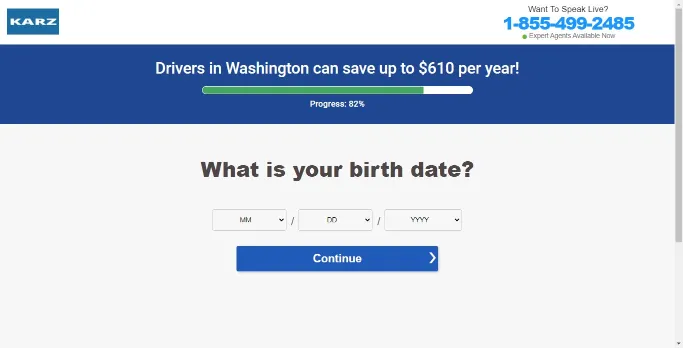

Step 13: Enter your Date of Birth

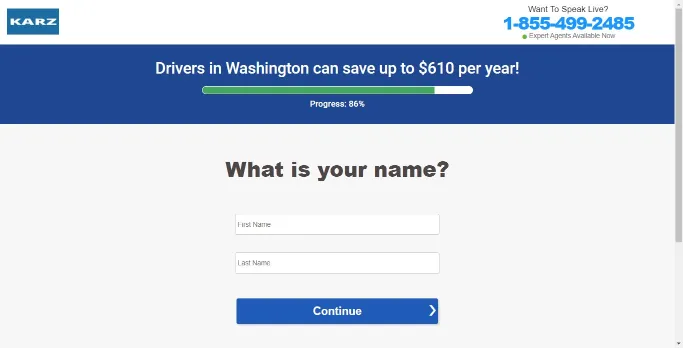

Step 14: Enter your First and Last Name

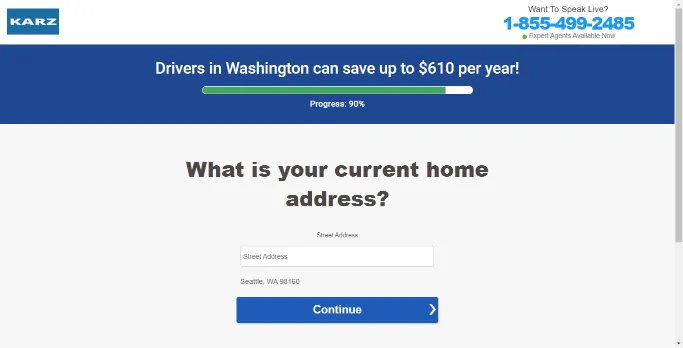

Step 15: Enter your Home Address

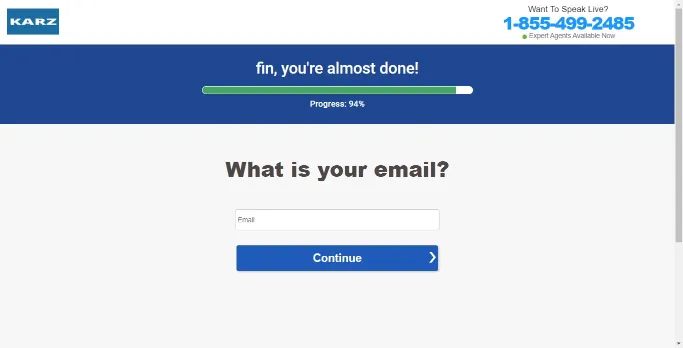

Step 16: Enter your Email

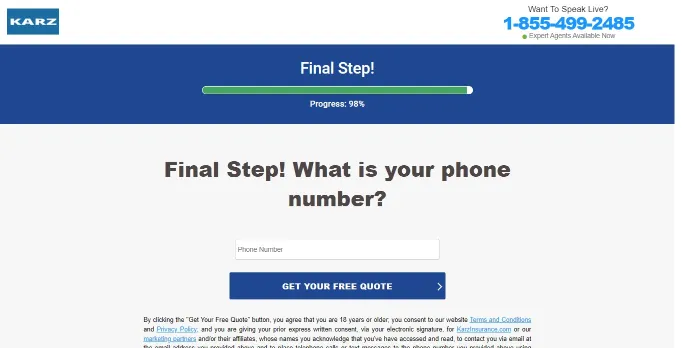

Step 17: Enter your Phone Number and click on “Get Your Free Quote.”

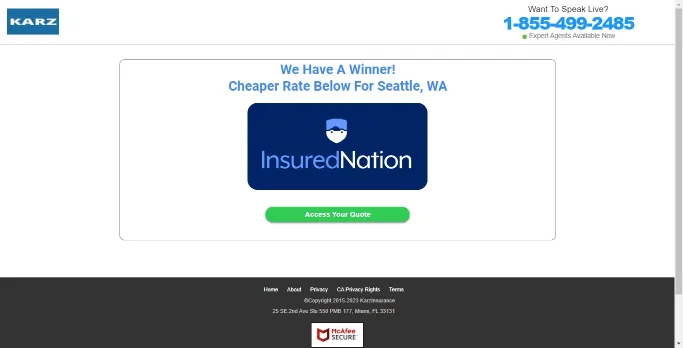

Step 18: According to the information provided, the best option is “Insured Nation.” Click on “Access Your Quote”

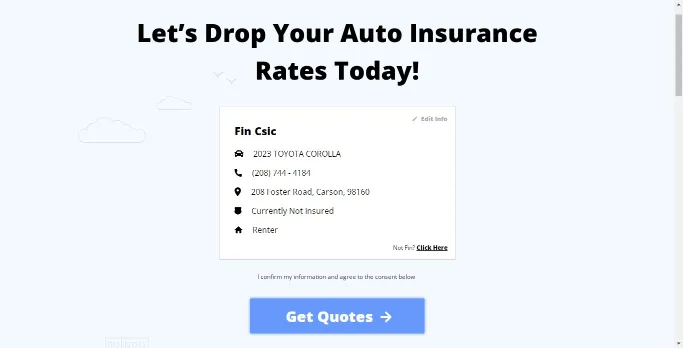

Step 19: It takes to the Insure Nation’s website with the information already passed on from Karz Insurance. It is displayed on a box. Click “Get Quotes”

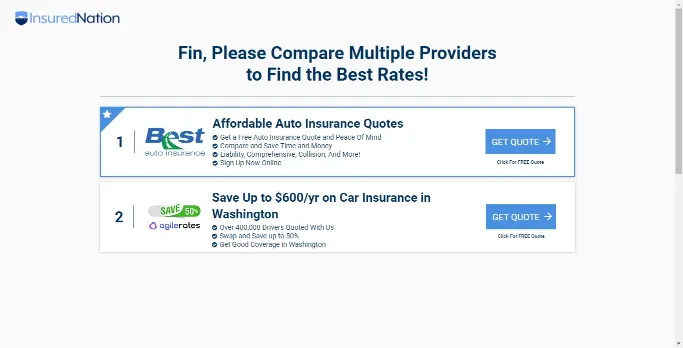

Step 20: It further gives two options “Best Auto Insurance” and “Agile Rates.” Best Auto Insurance was selected by clicking “Get Quote” and providing the relevant information as asked.

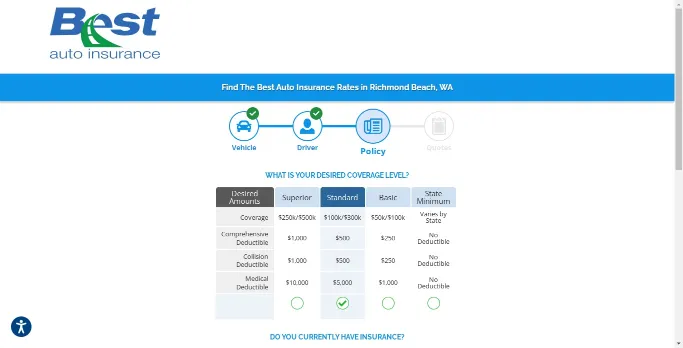

Step 21: Four Quotes were presented by Best Auto Insurance as Superior, Standard, Basic, and State Minimum. If you want to buy the insurance, you simply need to select the best option as per your need and then continue, provide the relevant information, and then pay to complete the process.

Note: Instead of buying online, you can call Karz Insurance’s live consultation phone number at 1-855-499-2485 to describe your coverage needs, get the quotes accordingly, and then buy it if finalized.

Once you have received the quote via the suggested insurance companies by Karz Insurance, you can buy the current policy online if the coverages are adequate with affordable rates or call that insurance agent to finalize the deal, or you can also ask to meet face to face at their local agency office and buy it physically.

Karz Insurance is known for its exceptional level of service and customer focus. You can contact them at the following:

Phone: 1-855-499-2485 – Call to speak to a live consultant about auto insurance quotes.

Email: [email protected] – Send a mail if you have any query

Note: They don’t have any chat option.

Although different types of coverage are available with auto insurance, the aim should be to take the highest amount of liability coverage they can if it is something they can afford. 100/300/100 is considered the best coverage option for car insurance.

You should always have the minimum coverage as per your state’s Insurance Law and regulatory requirements and additional coverages such as collision coverage, accident coverage, comprehensive coverage, rideshare coverage, gap coverage, roadside assistance, bodily injury liability coverage, medical costs, etc. if you want to protect yourself and the vehicle.

If your car keys are lost or stolen, the KP or Key Protect Add-on cover will protect you from the replacement costs. It is not a part of standard auto policies and has to be purchased additionally.

PB refers to Payer Benefit, which means that the Insurance Company will give the life coverage and waive the annual premium if the payer dies or becomes permanently disabled.

Read More:

Suppose you are perennially busy and don’t have enough time to sit and research the auto insurance companies or coverage types. In that case, Karz Insurance can be a valuable tool that will give you access to the market with multiple options.

It will do the hard work for you and offer you choices tuned to your vehicle type, location, credit score, and other essential factors, and also try to keep the average price of the premium as low as possible.

It may or may not be the best option for you in terms of the variety of coverage options that you require and may not offer the lowest auto insurance premiums, but then again, you need to conduct thorough research.

However, it may even be the case that the offer they suggest is the best one that covers all the necessary coverages in the applicable insurance policy.

If you need affordable car insurance coverage such as collision insurance or minimum liability insurance quickly without much hassle and also get multiple options suited to your needs and affordable auto insurance rates, then go for Karz, which works with legit popular car insurance companies or conducts thorough research for an underwriting insurer that offers additional products or specialized products that suits your coverage needs and budget.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Karz Insurance or any of its partner Insurance Companies. The product information may vary. Please check the issuers’ websites for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any insurance issuer. The content is for informational purposes only. It is not financial advice.

Share this post:

Table of Contents Most insurance policyholders pay little heed to their insurance policy’s coverages, deductibles, and terms and conditions. As a result, many are unsure

Table of Contents Insurance is an integral part of our modern life, and homeowners insurance is one of the most important insurances that have become

Table of Contents I interviewed an experienced insurance agent from a reputed global insurance company who pointed out why many young insurance agents leave their