Otto Insurance Review: A Comprehensive Study

Table of Contents Are you looking for multiple insurance products like home or car insurance and wondering if Otto Insurance is the solution to your

Do you want to know more about Amigo Insurance before you buy it? Want to delve into the details of Amigo Insurance and understand its detailed offerings?

This article dives deep into the minute details of Amigo Insurance. It thoroughly examines its policies, coverages, and services to help you make a knowledgeable decision.

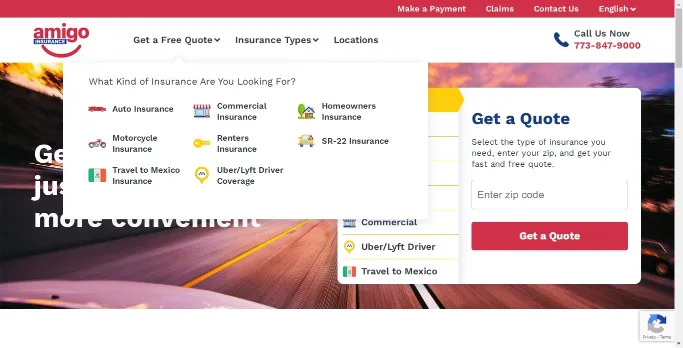

Amigo Insurance Agency is an Illinois-based private Insurance company that offers insurance products and services in multiple verticals, including Auto Insurance, Motorcycle Insurance, Homeowners Insurance, Commercial Insurance, Renters Insurance, SR-22 Insurance, Travel to Mexico Insurance, and Uber/Lyft Driver Coverage.

Following their tagline “Quote, Pay, Print and Smile,” their focus is to simplify the process for clients to get customized insurance as per their needs and lead a peaceful life.

Company Name | Amigo Insurance Agency, Inc. |

Year Founded | 2003 |

Headquarters | Cicero, Illinois, USA |

President & CEO | Carlos Santiago |

Number of Employees | 68 |

Revenue | $19.5 million |

website |

Amigo Insurance offers a wide variety of Property and Casualty (P\C) Insurance products and services specializing in Auto Insurance.

The types of insurance products and services offered by Amigo’s insurance chain are as follows:

Auto Insurance is a must if you own a car, as it saves you from financial loss or any other costs associated with a car accident. Car accidents are unfortunate events that do happen.

If you or your car damages the property of others or causes bodily injury, then there is a high possibility of you getting sued. Proper auto insurance saves you from such instances. Amigo solves that issue with economical auto insurance rates and reliable vehicle coverage.

Amigo Auto Insurance provides one of the most comprehensive auto insurance with all the essential coverages at affordable rates. It also allows you to customize the insurance policy and coverages to suit the client’s needs.

If there are damages caused to your car or if your car is stolen, the Property Coverage offers protection

The Liability Coverage protects you against lawsuits if you are responsible for property damage or bodily injury to others due to an accident.

In case you need to treat your injuries, rehabilitate, or sometimes if you have lost wages because of your inability to work post-accident or if the accident results in death and there is a need to arrange a funeral, then the costs associated with all these things are covered by the Medical Expenses Coverage.

Note: Usually, there are six different kinds of coverage in Auto Insurance. Most of the states require only some of them. However, some states and the lender from whom you are financing the car may ask for all the coverages to be included.

Amigo Motorcycle Insurance provides comprehensive, affordable rider and motorcycle coverage.

It provides the same coverages as included in Amigo’s Auto Insurance Policy.

Amigo Commercial Insurance is designed to protect your business from unforeseen events.

They protect you from damages caused by any accident or unfortunate events. It also protects you from a lawsuit from your employees if they are victims of an accident or feel they have been wrongly terminated.

It also offers protection to items and equipment, including cars used for business. You can always speak to the Amigo Commercial Insurance agent to customize your policy to suit your needs as per your business and the kind of risks that your business face.

Some of the additional commercial coverages that can be included separately are as follows:

Home is the most expensive investment for most people in their lifetime. So, protecting an investment as valuable as this is always a good idea.

If your home is caught up in any disasters, then Amigo Homeowner’s Insurance offers protection against the financial losses you may incur.

It is a package policy that includes damage to your property and the liability to pay for damages to anyone else’s property or bodily injury to other family members or anyone else. It also includes pets.

It covers most disasters, such as floods and earthquakes, with some exceptions. However, you should remember that the coverages for floods and earthquakes are separate and must be added to your policy to be covered.

If you are a victim of a natural disaster or a fire and your house is damaged or destroyed in the process, the insurance will cover the expenses to repair or replace it altogether.

This coverage protects against any costs associated with injury, liability, and medical care of guests in your home.

It covers the loss or the cost of repair of your house just in case you are a victim of theft or vandalism.

If you have financed your home, the lender may require insurance for any unforeseen events. This coverage provides protection for your lenders in any such situation.

Note: The homeowners must remember that the Amigo Homeowners Insurance will cover costs associated with unforeseen events or incidents and will not cover costs associated with routine maintenance. It is the homeowner’s responsibility.

Renters insurance is for those renting places to stay and not owners of that home. All your belongings in a rented place or a friend’s place are not insured, even if the house owner has home insurance.

Amigo Renters Insurance is a cost-effective way to protect your items and belongings from fire, theft, smoke, etc. In the case of any disaster, the renter’s insurance will pay for the repairs or even replace them if they are a total loss.

It offers protection of your personal properties in the rented house, including clothes, electronics, jewelry, and furniture.

It offers protection in case you are in a situation where you are suddenly without a place to stay and need money for food and a temporary place to live.

It offers liability protection if somebody sues you if they are injured while at your rented property.

Sometimes the DMV may ask for SR-22 Insurance in addition to regular Vehicle Insurance if you drive under the influence of alcohol, drive without proper vehicle insurance, are a habitual offender, or were involved in an accident.

Amigo SR-22 Insurance offers services to cover the requirements of the DMV. The cost of the premium may vary depending on the severity of the violation or the offenses.

For example, suppose it is just a parking ticket violation. In that case, the premium will be standard and affordable. Still, if someone is driving under the influence of alcohol or drugs, it may significantly increase the value of the premium.

If you are in Mexico and unfortunately have an accident, your Auto Insurance from the United States will not cover it.

Amigo Travel to Mexico Insurance ensures you are covered for minimum liability, including damages and injuries, so you can drive freely with peace of mind and without worrying about Mexican Authorities detaining you to prove that you can cover the costs.

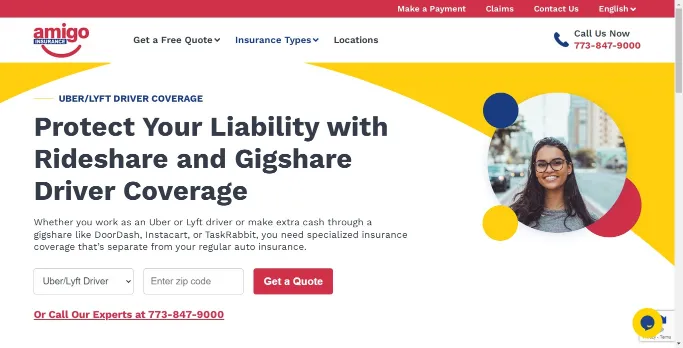

Suppose you are an Uber or Lyft Driver or any driver for any other gigshare companies like DoorDash, Instacart, or TaskRabbit. In that case, it is advisable for Amigo’s Uber/Lyft insurance coverage.

Although companies like Uber and Lyft provide insurance, if you are driving and not delivering a package and meet with an accident, your insurance may not cover the injury or damage costs.

So, without proper coverage in such instances, you will become a victim of substantial financial loss, whether you need bodily injury medical costs or if others sue you because of the injury caused by you to them or their properties.

Amigo’s specialized Uber/Lyft Coverage ensures it offers you protection with coverages beyond the minimal requirements of the rideshare companies.

As per Zoominfo, Amigo Insurance’s Top Competitors are as follows:

| Name of the Insurance Company | Revenue | Number of Employees |

|---|---|---|

| Cal Coast Insurance | $ 97.3 million | 74 |

| Clauss Bovard Agency Inc. | $8.8 million | <25 |

| Nielsen-McAnany Insurance Services Inc. | $11.5 million | 40 |

| Insuramerica | $6.5 million | <25 |

| Funakoshi Insurance Agency | $6.9 million | 33 |

| Purdy Insurance Agency Inc | $6.8 million | <25 |

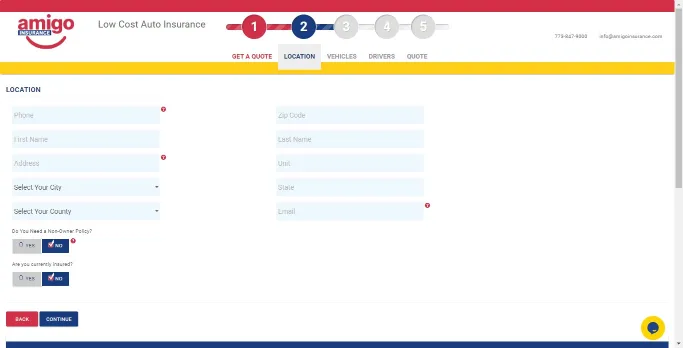

To get the quote through their online service, follow the following steps:

Step 1: You need to visit the Amigo Insurance Homepage.

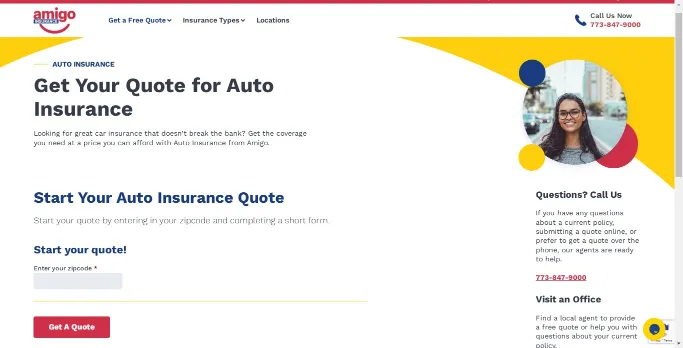

Step 2: You can either select the type of insurance you want and then enter the Zip code and click the “Get a Quote” button on the “Get a Quote” form in the top right section and go straight to the form page, or You can click on “Get a Free Quote” button on the main menu.

Step 3: As the page loads, click the “Get a Free Quote” button on the main menu, and enter the zip code.

Step 4: Then as the form loads, enter all the information regarding your location, name, and email and check whether you want a Non-owner Policy or not and if you already own insurance, and then click “Continue.”

Note: It should be noted that online Quotation may not be available for specific states, and a direct agent needs to be contacted for a quote. If it is not allowed, it will display a message on the screen when getting a free quote.

To Get Quotes over a Call, contact the following number: 773-847-9000

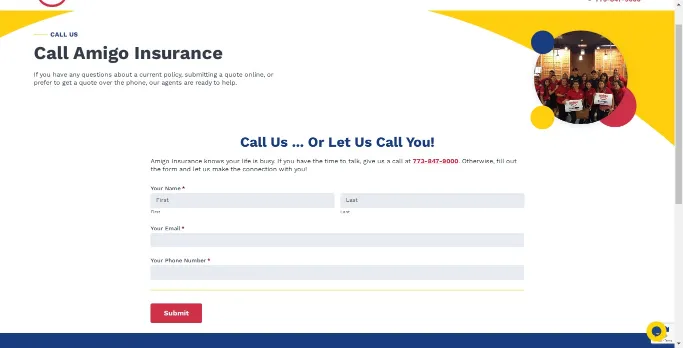

If you want the agent to call you, go to Amigo’s Call Us Page, fill out the form, submit it, and the insurance agent will you back.

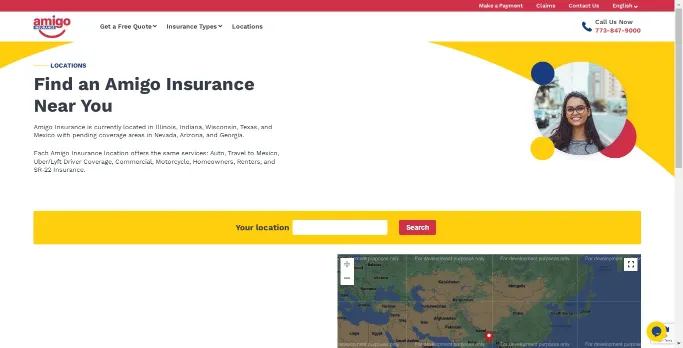

Amigos is currently present in Illinois, Indiana, Wisconsin, Texas, and Mexico, with pending coverage areas in Nevada, Arizona, and Georgia.

To get a quote in person, go to Amigo’s locations page and enter your zip code. It will show the locations with marker pins on the map where you can visit to talk to Amigo’s agents in person.

You can either get a quote online by filling out a form and after looking at the policy and the premium costs, you can pay online to buy Amigo Insurance.

Alternatively, you can talk to an agent over the phone or physically, discuss your requirements and draw up the coverages according to your need and then purchase the policy through the agent.

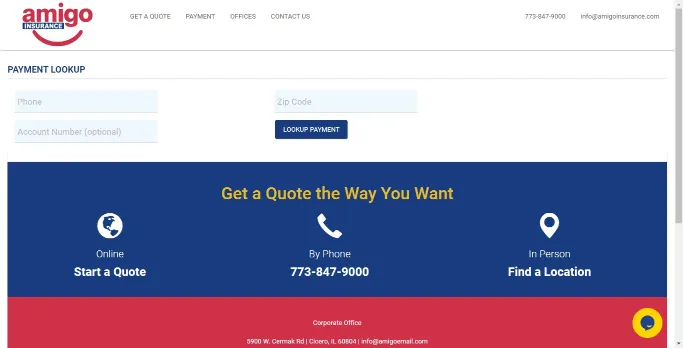

To make a payment online, you can either go the Amigo’s home page and scroll down to the footer and click “Make a Payment” or go to Amigo Insurance’s payment page and make the payment by fetching your details after entering your phone number and zip code. You can also enter your account number, but it is optional.

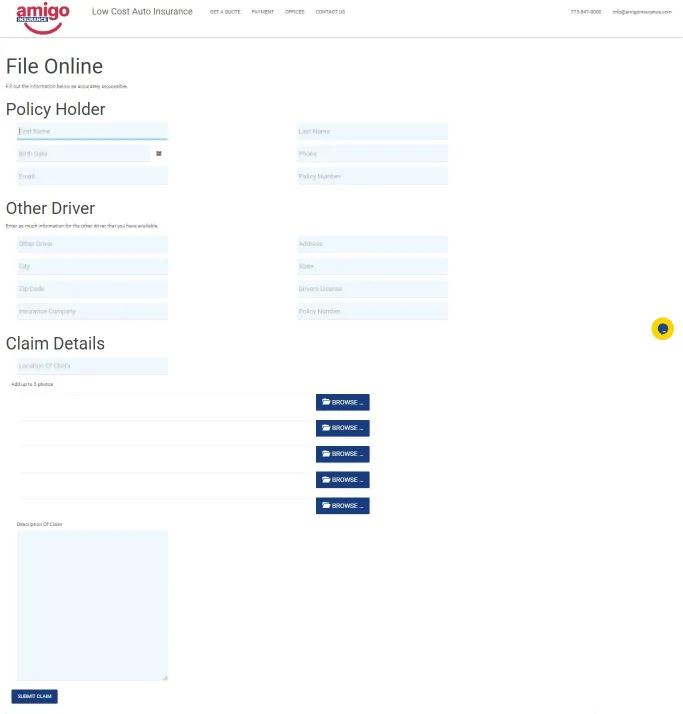

1. To File a claim, you can visit Amigo’s home page, scroll down to the footer, click “Claims,” or go directly to Amigo’s Claims Page.

2. Then Enter the following details:

3. Click on “Submit Claim”

Alternatively, you can call them at 773-847-9000 or mail them at [email protected].

If you have any questions about coverage, you can also ask them by sending a message by writing the name, subject, and email. The agent will then respond asap.

If you are using an Android phone, you can download the Amigo Insurance Mobile App from the Google Play Store to manage your account.

Amigo Insurance provides reliable coverage for multiple verticals and is known for its customer service. To get hold of their diversity of coverage and valuable services, you can use the following methods of communication.

Amigo Insurance Phone Number: 773-847-9000

Amigo Insurance Email: [email protected]

If you are involved in an accident with an uninsured person, your auto insurance will bear the costs of damages and medical expenses, but only if it has full coverage. Liability-only coverage will not cover accidents with uninsured drivers.

Suppose you are held as the at-fault party in an accident, and the damages or the medical expenses exceed your policy coverage limitations. In that case, you will be held personally liable to pay the excessive remaining amount. If your coverage is $25000 for property damage, but the actual damage is $30,000, then your insurance will pay the $25,000, and you need to pay the excess $5000.

Liability Only Insurance covers only the minimum insurance coverage requirements of the state. However, it only covers the costs of the damages or medical expenses of the other driver or damage to the property of others, but it does not cover the damages, repairs, and replacement of your car.

On the other hand, Full Coverage Insurance covers the cost of damages, repair, salvage of vehicle, and replacement of your vehicle, but a deductible (ranges between $500 to $1000 mostly) must be paid by you.

Read More:

Amigo Insurance Agency Inc. is a small private insurance providing comprehensive auto insurance and many other insurances as part of their wide array of P\C Insurance offerings. It can be a good option for the people of the states where it is present who want good insurance at an affordable price.

It also offers customization options to suit your needs. It can be a great fit if you are a first-time buyer who wants to test the water by buying insurance and upgrading to better offerings.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Amigo Insurance. The product information may vary. Please check the issuer’s website for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any insurance issuer. The content is for informational purposes only. It is not financial advice.

Share this post:

Table of Contents Are you looking for multiple insurance products like home or car insurance and wondering if Otto Insurance is the solution to your

Table of Contents Are you looking to buy insurance for your motorcycle? Have you heard of Harley David Insurance but are unsure whether it is

Table of Contents Want good insurance for your vehicle? You have heard about Karz Insurance but are still determining whether it is the best fit