How Mortgage Brokers Rip You Off: Exposing 7 Secrets

Table of Contents Are you planning to buy a home but worried about financing? Then it would be best if you avail yourself of a

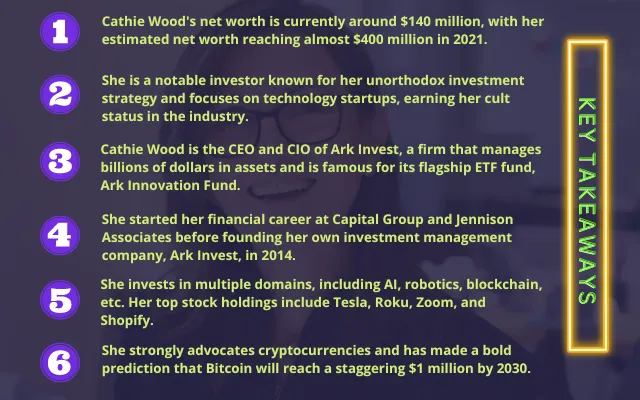

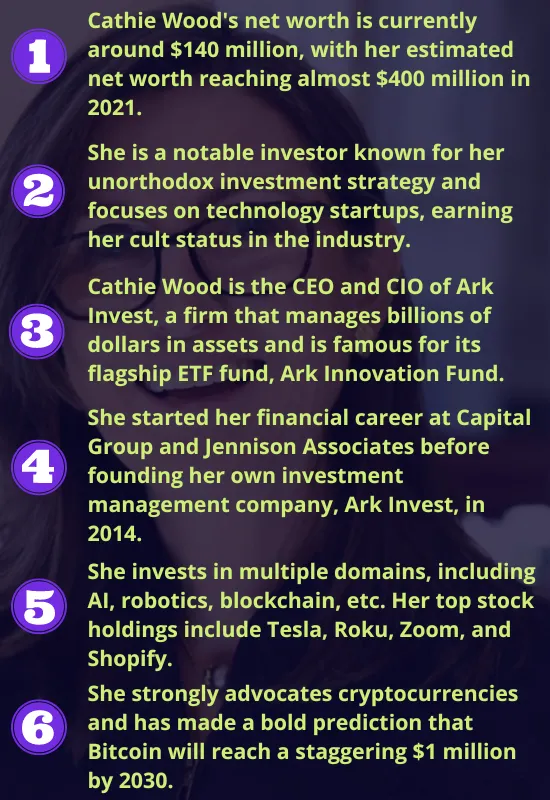

Cathie Wood net worth is $140 million approximately. She is one of the most noted investors of our age who has a slightly unorthodox investment strategy compared to her traditional contemporaries.

She has often been patronized for her focus on technology startups by her acquaintances in the industry. Still, she fought hard to cut through the clutter and make a name against the popular narrative.

Although Cathie Wood has been involved with the financial industry since her University days, she rose to fame and received cult status in 2020.

But these startups with cutting-edge technologies catapulted her to this position.

However, after the excessive rise in her company Ark Invest’s portfolio by almost 157%, it had to bear the brunt of the bear market and various other macroeconomic factors. It reduced the company’s portfolio value from $60 billion to approx. $ 13.8 billion.

Cathie Wood, an expert financial investor, made her money in finance for a career spanning over 40 years.

Not only did she work in financial institutions and draw an exceptionally high salary, but she made millions when she started her investment firm Ark Invest in 2014.

Cathie Wood’s net worth is currently around $140 million, as per the latest reports by Forbes. Her estimated net worth reached a high of almost $400 million. 2021 it saw a 65% owing to market conditions and other macro factors.

Cathie Wood, aka Catherine Duddy Wood, is an investment professional and an expert stock picker who has made her name owing to her investment firm Ark Invest. She is currently the CEO and CIO of the firm.

She handles billions of dollars of assets in Ark Invest, and her flagship ETF fund, Ark Innovation Fund ($23 billion), made a 45% annual growth for a record five-year period.

She has worked in different positions in huge investment firms, from a portfolio manager to a CIO.

She is also an early adopter of tech innovations and strongly supports the likes of Tesla and Roku.

Of all the female fund managers, she is one of the world’s wealthiest.

She is famous for her predictions in the investment space, such as that Tesla will reach a valuation of $3 trillion which is higher than most major economies worldwide. During an interview with Barron in 2006, she even predicted the 2008 housing collapse.

Cathie Wood was born to Irish immigrants in 1955 on 26th November. She is 67 years old and will turn 68 this year in November.

Cathie Wood’s husband was Robert Wood, who passed away in 2018. They were already separated by that time.

They had three children Caitlin, Caroline, and Robert.

Cathie graduated summa cum laude from Southern California with a BSc Degree in Finance and Economics in 1981. She was always keen to work in finance, and this degree paved the way for her career in investment management.

Was Cathie Wood young when she started working? Yes, she was only 22 when she started working in 1977 as an assistant economist at Capital Group for three years.

She got this job with the help of his mentor, Arthur Laffer, who was also an economist and one of Cathie’s professors.

Cathie moved to New York in 1980 because she joined Jennison Associates. She worked for them for an extended period of 18 years.

She played multiple roles while she was employed there.

Note: She came to the limelight in the 1980s because she debated with Henry Kaufman why she believed the reasons behind the spiking of interest rates.

Cathie’s entrepreneurial spirit guided her to establish a hedge fund company named Tupelo Capital Management in New York.

Cathie joined Alliance Bernstein as the global thematic strategy’s CIO or Chief Investment Officer. She managed a portfolio size of $5 billion and worked there for 12 years.

She received a lot of criticism while working there, especially in 2007-2008 when the banking crisis happened and the recession hit the market. But her performance was the worst as compared to other investment professionals.

As Cathie’s interest in disruptive technologies grew, and she wanted to invest in ETFs based on these newer tech companies and startups, her difference with Alliance Bernstein grew louder and louder.

Finally, she left Alliance Bernstein and founded Ark Invest, an investment management company, in 2014. Cathie is quite vocal about her religious views and identifies as a devout Christian, so she named Ark Invest after the Ark of the Covenant.

She secured the seed capital for her first four ETFs from Archegos Capital, headed by Bill Hwang, who is infamous for losing $10 billion in 10 days in Mar. 2021.

She is a tech investor who made substantial wealth by investing in these disruptive technologies. She even predicted a $3000 Tesla stock by 2025. At her peak, Cathie Wood’s net worth was $400 million, and Ark Invest was handling assets worth $60 billion.

Now, Cathie, as compared to more traditional investors, follows an investment philosophy known as thematic investment strategies.

She often seems to follow a strategy that is anti-Buffet. Warren Buffet is synonymous with brilliance and intelligence. He invests in the stock market with traditional investment strategies.

He usually studies large-scale companies and financial institutions by studying their historical performance and their trends in the recent past. He is a much less risky investor, investing only in companies with consistent performance.

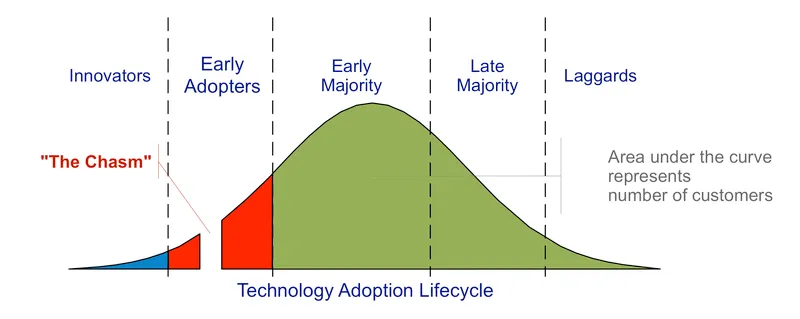

On the other hand, Cathie doesn’t care for short-term trends, and her company Ark Invest invests in disruptive tech companies that show great potential in the future. So, she tries to take advantage of being an early adopter and gain value over a long period.

She studies the company, the technology that might bring revolution, and the team involved. She is not concerned about the sector or historical data and chooses the company based on her investment experience and the company’s future value.

Even if the company shows a temporary spike in performance or parabolic growth, she will only invest in it if it would sustain over the long term. So, thematic strategy is a long play.

Since her investment is not restricted to a particular sector, she has a diversified portfolio, including developing state-of-the-art technologies in various fields and producing life-changing products and services.

They spread across multiple fields, and their fund offering includes AI or Artificial Intelligence, Electric Vehicles, DNA Sequencing, Gene Editing, Robotics, Energy Storage, Mobile Technology, Agricultural Biology, Autonomous Technology for 3D printing, and Blockchain Technology.

Like electric vehicle maker Tesla’s founder Elon Musk’s SpaceX, she also has a keen interest in Space Tech. One of her ETFs includes companies working with various aspects of space exploration.

Since she is an innovator or early adopter phase per the technology adoption curve due to her investment practices and focuses on tech-related investments, she is often referred to as “Queen Cathie” or “Cathie Bae” in pop culture.

She is also a big pusher of blockchain technology and cryptocurrency and has often publicly spoken in favor of Bitcoin. It has been the norm for many investment bankers post crypto’s exponential growth.

Despite the FTX collapse and other crashes in the crypto sector last year in 2022, she believes Bitcoin will thrive.

She is an optimist and is committed to the cause of pushing these startups with disruptive innovation.

She had even invested significant wealth for almost three years before they secured external investment. She mentioned this while on Jesus Calling’s podcast.

According to her investing philosophies, she believes that even if the companies are performing poorly in the stock market due to the current bearish sentiments, in the future, their value is bound to go up as their tech creates more value in people’s lives.

Hence, she made money by forming an Asset Management Firm and holding them long term to cut it short. She bets on the technology of these newer and riskier tech companies.

She has developed the mindset with a higher risk tolerance to absorb the short-term losses as part of the journey to becoming ultra-successful in the long term. It is why many people follow her investment advice.

Example: When Michael Burry wanted to short Ark Funds, she was not worried as her focus was technology. Their continuous advancement is a long-term game and is not affected by short-term negative or positive bursts.

At the time of writing, Cathie Wood’s Ark Invest has a vast portfolio of 223 Stocks, including Tesla, Roku, and Zoom. She also has stakes in Shopify. Check the entire portfolio here.

The current value of their total AUM or Assets Under Management is $13.8 billion.

The top 10 Cathie Wood’s stock picks in terms of percentage of their portfolio & corresponding stats are as follows:

| # | Stock Name | % of Portfolio | Avg. Buy Price | Current Price | Last Transaction |

|---|---|---|---|---|---|

| 1. | Exact Sciences Corp. | 7.3% | $102.57 | $62.45% | Q4 2022 Sold 8.7% Shares |

| 2. | Tesla Inc. | 6.8% | $83.40 | $202.77 | Q4 2022 Increased shares by 13.3% |

| 3. | Roku Inc. - Class A | 5.6% | $147.04 | $63.64 | Q4 2022 Increased by 1.7% |

| 4. | Zoom Video Communications Inc - Class A | 5.4% | $247.06 | $69.62 | Q4 2022 Sold 2.5% |

| 5. | Block Inc - Class A | 5.0% | $130.57 | $76.63 | Q4 2022 Sold 2.1% Shares |

| 6. | UiPath Inc - Class A | 4.7% | $47.66 | $14.58 | Q4 2022 Sold 4.4% Shares |

| 7. | Coinbase Global Inc - Class A | 4.3% | $197.34 | $64.67 | Q4 2022 Increased Shares by 19.1% |

| 8. | Shopify Inc - Class A | 3.9% | $71.08 | $40.10 | Q4 2022 Sold 8.6% Shares |

| 9. | Teladoc Heath Inc | 3.6% | $179.74 | $25.88 | Q4 2022 Sold 9.3% Shares |

| 10. | Twilio Inc Class A | 3.5% | $226.94 | $65.74 | Q4 2022 Increased Shares by 8.5% |

Cathie often says that her funds are like venture capital funds for the public.

Let us have a look at the flagship funds of Cathie Wood’s Ark Funds.

At the time of writing, ARK’s active Exchange-Traded Funds are as follows:

| ETF Name | Exchange | Inception Date | Net Assets | Expense Ratio | 5 yr Return |

|---|---|---|---|---|---|

| ARK Innovation ETF ARKK | NYSE Arca | 10/31/2014 | $7,664 Million | 0.75% | 0.63% |

| ARK Next Generation Internet ETF ARKW | NYSE Arca | 09/30/2014 | $1,246 Million | 0.88% | 2.99% |

| ARK Genomic Revolution ETF ARKG | Cboe BZX | 10/31/2014 | $2,247 Million | 0.75% | 5.38% |

| ARK Autonomous Tech. & Robotics ETF ARKQ | Cboe BZX | 09/30/2014 | $926.2 Million | 0.75% | 7.15% |

| ARK Fintech Innovation ETF ARKF | NYSE Arca | 02-04-2019 | $860.4 Million | 0.75% | - |

| ARK Space Exploration & Innovation ETF ARKX | Cboe BZX | 03/30/2021 | $282.4 Million | 0.75% | - |

| The 3D Printing ETF PRNT | Cboe BZX | 07/19/2016 | $189.9 Million | 0.66% | -2.13% |

| ARK Israel Innovative Technology ETF IZRL | Cboe BZX | 12-05-2017 | $105 Million | 0.49% | -1.27% |

At the time of writing, ARK’s investment management firm’s performance is as follows:

Table 1:

Market Cap | $65.3 Billion |

Dividend Yield | 0.04 % |

Beta | 1.8435 |

P/E Ratio | 99.01 |

Negative P/E Ratio | -18.25 |

Profitable Companies | 20 |

PEG | 62.56 |

Price to Sales Ratio | 7.25 |

Price to Book Ratio | 5.39 |

Table 2:

Enterprise Value to EBIT | -45.31 |

Enterprise Value to Revenue | 63.81 |

Total Debt to Enterprise Value | 0.1 |

Debt to Equity | 0.4658 |

Profit Margin | -1782.04% |

Quarterly Earnings Growth (YoY) | – |

Return on Equity | -38.86% |

Return on Assets | -14.82% |

Return on Invested Capital | -10.49% |

Ark did a record number in 2020, growing by almost 157%. But the highly inflated stocks took a massive dump in 2021 because of external conditions and various macroeconomic factors. Since then, the bearish sentiments have not improved, nor hasn’t Ark’s poor performance.

As per Ark Invest’s portfolio, Exact Sciences is their biggest holding occupying 7.3% of their entire portfolio, closely followed by Tesla with 6.8% and Roku with 5.6%.

Cathie Wood has lost almost $50 billion due to market conditions and inflated stock values. However, they have increased their shares in Tesla, Roku, and Coinbase, which indicates that she foresees a strong future in tech, electric cars, and blockchain technology.

We can see that Cathie Wood’s net worth peaked and then plummeted due to the extraneous circumstances and the bearish sentiments that crept into the market.

The continuous hike in the interest rates and the inflation is causing a financial crisis, and the entire market, be it crypto or stocks, is hurting. Naturally, her funds have also had a poor performance in the last financial year.

However, just like the market cannot be up forever, it will also not be down for eternity. As the market conditions improve and these companies further strengthen their technologies and provide real-life solutions, their value will increase, and so will Cathie Wood’s net worth and Ark’s portfolio size.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. The author’s opinions are their own and should not be taken as a recommendation to invest in any particular product or service. It is strongly advised that you consult a financial advisor before making investment decisions. Investing always carries risk, and it is up to each individual to consider their options and make informed choices carefully.

Share this post:

Table of Contents Are you planning to buy a home but worried about financing? Then it would be best if you avail yourself of a

Table of Contents Are you a hustler? Are you someone who is always looking for an opportunity to make some quick bucks on the sideline?

Table of Contents Annabella Rockwell net worth is $5 million approximately. However, no official data is available regarding how much she earns or the wealth