How to Liquidate Credit Cards & Master Your Finances (2023)

Table of Contents Credit cards have become integral to most of our lives as it helps us manage our financial needs in a fast-paced digital

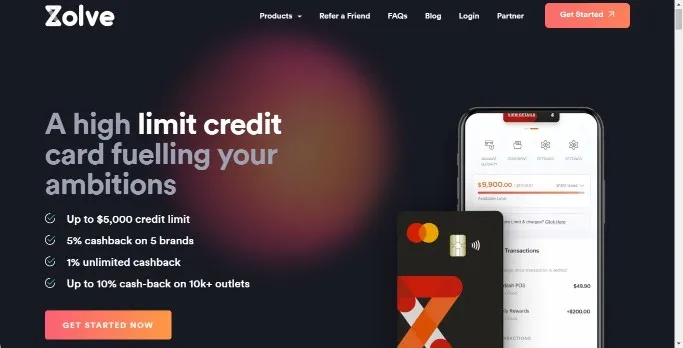

Are you looking for the Zolve Credit Card but unsure whether it suits you? Do you want to know about the features and benefits of the card before you make up your mind?

This article dives deep into the details of the Zolve Credit Card and thoroughly investigates the features, benefits, fees, rewards, and drawbacks, which would help you make an informed decision.

Zolve is a new-age fintech company that provides neo-banking services. Their cross-border financial services are seamless and offer every American and individual migrating to the USA an opportunity to open a US bank account and avail of various other financial services in a foreign country, from credit cards to loans.

Zolve was founded by Raghunandan G. in Bangalore in the year 2020. The idea to open Zolve struck him during a dinner at a restaurant when he witnessed his friends paying with debit cards instead of credit cards, as they were ineligible for credit cards in the US.

Moreover, 30% of Americans do not have access to banking services, especially laid-off workers and minorities. The macroeconomic factors have further worsened the situation. According to the Consumer Finance Protection Bureau (CFPB), 1 out of 5 people cannot qualify for loans.

Zolve was founded to address all these issues and make financial services to all sections of society.

It is the first Indian startup to receive funding from Founder Collective. It received a seed round funding of $15 million and then raised a Series A funding of $40 million from Lightspeed Venture Partners and others.

Company Name | Zolve Innovations Inc. |

Founder | Raghunandan G. |

Year Founded | 2020 |

Headquarters | New York |

Industry | Financial Software |

Number of Employees | 184+ |

Capital Raised | $55 million |

Market Value | $210 million (as of 27 Oct. 2021) |

Website |

Zolve offers different kinds of financial services. They are as follows:

Zolve offers a credit card called Zolve Credit Card as part of its wide range of financial products and services. However, they are a fintech company, not a traditional credit card company. They are not a bank or a lender, so they are not directly offering these credit services.

Its lending partners or partner banks offer it. Zolve Credit Cards are issued by Community Federal Savings Bank and Members FDIC pursuant to its license from Mastercard.

According to the FED, 50% of credit applicants with an income level less than $50,000 were either denied, or the loan amount was reduced from what they were asking for. It was owing to the prenotion that they are risky clients as they have no or limited credit history.

It is also true for the millions of immigrants who flock to the USA yearly. It is especially difficult for them to get hold of simple things like a mobile phone or a house despite having a credible credit history in their country of origin. They also do not have any option in case an emergency expense arises.

So, the perennial problem is that you need credit to apply for a credit card or other financing options, and you need a credit card for approval of credit products.

Zolve believes that access to money should not be a problem for these people. Hence, it solves this problem and introduces the Azpire Credit Card or the Azpire Credit Card Builder Card, which allows cardholders to build their credit by simply depositing the money in the associated Zolve account and using it for any transactions. Your credit keeps building as you use the card for every transaction.

Zolve Azpire Credit Builder Card vs. Typical Credit Cards vs. Typical Debit Cards

Azpire Credit Builder Card Typical Credit Cards Typical Debit Cards

Credit Reporting & building It is a secured card that helps to build strong credit by reporting all your transactions to the top three credit bureaus. Reports to major credit bureaus. Does not report, so it doesn’t aid in building any credit

Rewards Up to 10% cashback & Reward Points Up to 10% cashback & Reward Points Up to 10% cashback & Reward Points

APR or Late Fees No APR or Late Fees Up to 29% or even more in some cases No

Application Fee Zero Application Fee Yes No

Annual Fee Zero Annual Fee Yes No

Credit Checks No Yes No

Minimum Balance No Minimum Balance requirements No Depends on the card

Graduation to a high-limit card Zolve offers a simple and seamless way to increase credit limit The Limit can be increased No

The eligibility criteria for all types of Zolve Credit Cards are as follows:

Note: Eligibility criteria may change from time to time. Check the company website for the latest information.

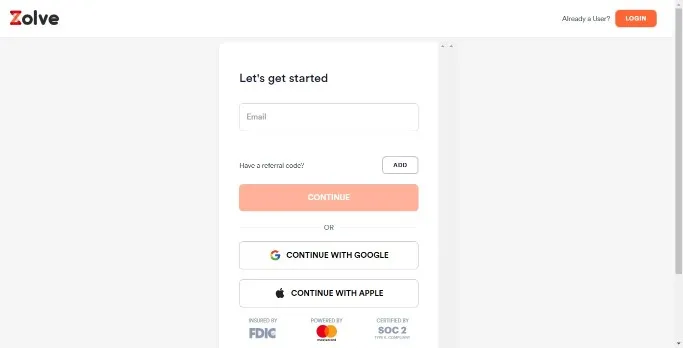

The application for credit cards by Zolve takes less than five minutes.

Follow the steps:

Step 1: Go to the Zolve website.

Step 2: Select the card type (Zolve Credit Card or Zolve Azpire Card) by clicking on the “Products” tab on the main menu

Step 3: Once Selected, click either “Get Started” or the “Apply Now” button.

Step 4: As the signup page loads, sign up with your choice of signing up method.

Step 5: Provide information as they keep asking.

Step 6: Upload all the necessary documents, and you are done.

Once your documents are verified, your credit card will be delivered to your correspondence address.

Note: You can use your Virtual Azpire Credit Card as soon as your application is approved and you activate your account and link the Virtual Azpire Card to a payment app like Apple Pay or Google Pay.

The delivery of the credit card is subject to credit approval by the lending partner. It takes about 7-10 working days for the Zolve credit card to be delivered to your home after you have completed the application process and approved by the loan partners. If you are traveling from abroad, it takes 7-10 days after you have landed in the US and updated your correspondence address.

Zolve is a very safe-to-use secured credit card. They have the following safety features:

You can deposit money to your Zolve Azpire account in the following ways:

For any transaction-related disputes, you can contact them via the chat option on every website.

You just need to scroll down, click on the chat icon in the bottom right corner, and contact their representatives to convey your concern.

For credit report-related issues, you can talk to a representative through the chat option or call the Zolve Credit Card Customer Care number at +1 (213) 406-7896.

Yes, Zolve is a fintech company that offers credit cards for US residents and immigrants moving to the USA. Their credit cards focus on people with no or low credit scores and help them build credit scores with their spending.

The USP of Zolve Credit Card is that your transactions are recorded and reported to the top three credit bureaus in the US. Credit utilization reporting helps you build a solid credit score from Day 1in the USA. A US resident with low credit or immigrants with no credit in the USA can use this service to build credit over time.

Zolve is partnered with Community Federal Savings Bank to offer lending and other banking services to Zolve’s customers.

Zolve Azpire Credit Card or Zolve Azpire Credit Score Builder Card is the best one as it provides a high credit limit or rewards and cashback and helps you build your credit with all the transactions made with this card.

Yes, Zolve helps you build your credit in the USA with the help of their Zolve Azpire Credit Card and the related Zolve Azpire Account. Everything that you spend with the help of this card or any money you deposit in this account is calculated and then sent to the top three credit bureaus, which help build credit for US residents and immigrants in the USA.

Read More:

Zolve is a typical fintech startup that aims to solve a problem that needs some introspection. This chicken-and-egg problem of credit cards and credit scores has been there forever, but no one thought of resolving it until now.

With globalization and more people traveling to the USA from different countries, the problem has become more apparent as many of the society, including US citizens, do not have access to proper banking and financial services.

Zolve has successfully tried to address the problem and alleviate the restrictions by introducing its credit cards and loan offers.

Zolve Credit Card is a revolutionary product for those immigrants who must perform all the transactions with their debit card. Their Azpire credit card even helps to build credit, eventually giving them access to other financial products in the US.

It is not a luxury credit card with access to luxury services, but it does solve the problem it aims to solve: access to credit cards and building credit for immigrants and US residents.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Zolve or Community Federal Savings Bank. Although all the information, including card rates, rewards rates, and fees, as presented in this article, is accurate as of the date it is written, the product information may vary. Please check the issuer’s websites for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any credit card issuer. The content is for informational purposes only. It is not financial advice.

Share this post:

Table of Contents Credit cards have become integral to most of our lives as it helps us manage our financial needs in a fast-paced digital

Table of Contents Best Buy is one of the most lucrative consumer electrics retailers offering a wide range of technology and software products, from digital

Table of Contents Are you a salon professional looking to take advantage of the Salon Centric Credit Card but wondering if it is worth it?