Rivian Stock Price Prediction 2025, 2030, 2040

Table of Contents Rivian rose to prominence and garnered a lot of public attention in the automotive industry when it became the largest IPO or

Confused about KMPH Stock and ZVRA Stock? Still wondering what happened to the KMPH ticker and want to learn more about KemPharm?

This article dived deep into understanding what happened to KMPH Stock and why they are not available anymore. It will enlighten you about the latest updates about KemPharm, Zevra Therapeutics, and the details of ZVRA Stock and its price forecast.

The specialty pharmaceutical company producing different proprietary prodrugs, KemPharm, Inc., and its ticker (NASDAQ: KMPH) is not available for trading because they have renamed their company Zevra Therapeutics. The new ticker for trading is NASDAQ: ZVRA.

According to a press release published in BioSpace, KemPharm changed its company name from KemPharm, Inc. to Zevra Therapeutics, Inc. on Feb 22, 2023.

The company’s CEO, Richard W. Pascoe, further announced that the new name reflects the company’s dedicated focus on transformational therapies for rare diseases with limited or no treatment options.

The name Zevra which is Greek for Zebra was chosen as it is widely recognized as the symbol of the rare disease community and would also help them to build a brand identity as a leader in the space.

Even the KemPharm Company Website leads to a landing page that says, “KemPharm is now Zevra Therapeutics.”

A button “Visit Zevra” leads to Zevra’s website and a message with a reducing timer of 15 seconds saying that it will automatically lead to Zevra’s website when the 15 seconds are up.

KemPharm was a clinical-stage specialty pharmaceutical company focused on serious diseases and medical conditions such as attention deficit hyperactivity disorder, pain, and other central nervous system disorders.

Company Name | KemPharm Inc. |

Ticker Name | NASDAQ: KMPH (Now Changed) |

Year Founded | 2006 |

Industry | Pharmaceuticals |

Headquarters | Celebration, Florida, USA |

Founders | Christal M. M. Mickle and Travis C. Mickle |

Beginning in 2001, Dr. Travis Mickle, with a team of scientists, invented a first-of-its-kind prodrug called Vyvanse that focused on the issues arising from treatments of ADHD or Attention Deficit Hyperactive Disorder available at the time.

Dr. Mickle was the team leader, and it took them three years (2004) to develop the prodrug.

With years of experience, Dr. Mickle finally co-founded a company called KemPharm, developing specialized prodrugs along with Christal Mickle.

They developed two commercial products with the help of its proprietary platform technology, Ligand Activated Therapy.

They developed the prodrug Azstarys, which FDA approved in March 2021. Corium, the product’s marketer, launched Azstarys in the US in the third quarter of 2021.

Additionally, in May 2022, KemPharm, acquired arimoclomol, an investigational product candidate treating Niemann-Pick type C disease, from Orphazyme A/S. The product is delivered orally.

Niemann-Pick type C is a rare disease that mostly affects children and can often turn fatal. There are no approved treatments for it in the USA at the moment.

KemPharm is focused on its long-term approach to progress into a commercially driven rare disease therapeutics company.

The then executive Chairman of KemPharm, Richard Pascoe, stated that the arimoclomol acquisition would enable them to expand their CNS disease development pipeline significantly.

He further said that this would help KemPharm build commercial capabilities that would help create and retain value for its shareholders.

He also mentioned that acquiring arimoclomol from an early access program would help the company generate positive cash flow and would not involve any shareholder dilution.

As we have seen, KemPharm was looking to become a company with the expertise of a rare disease therapeutic company. After gathering years of experience developing elegant prodrugs, the KemPharm team focused on getting product candidates for treating rare diseases.

KP1077 was the company’s internally developed clinical-stage candidate for rare diseases. It was developed to treat a rare sleep order called Idiopathic Hypersomnia or IH.

In May 2022, KemPharm finally acquired all the substantial assets of Orphazyme, A/S, a Denmark-based company that developed a product candidate called arimoclomol for treating Niemann-Pick type C disease (NPC).

Many team members were also internalized into KemPharm, which would help build a very experienced and robust team and help in their expansion and development capacity.

Finally, in February 2023, KemPharm was renamed Zevra Therapeutics.

Company Name | Zevra Therapeutics, Inc. |

Ticker name | NASDAQ: ZVRA |

Headquarters | Celebration, Florida, USA |

Industry | Pharmaceuticals |

CEO | Richard W. Pascoe |

Number of Employees | 36 |

Market Cap | $167.176 million |

Revenue | $10.46 million |

Company website |

Compared to most drug development companies, Zevra doesn’t follow the one-track path to develop the drugs, as this approach can minimize access to people who need therapeutics for rare diseases.

Zevra, on the contrary, pushes hard and takes a flexible approach to developing drugs. Their experience with successfully overcoming regulatory challenges and the technical know-how about developing therapeutic drugs help them to develop the drugs faster.

Most importantly, they don’t follow the archaic process of fitting the data in a pre-determined narrative as part of the product development process but analyze the data and then assess the best approach based on the data.

Let us now look at some important statistics of Zevra as reported by Yahoo Finance.

Revenue (ttm) | 10.46M |

Revenue Per Share (ttm) | 0.30 |

Quarterly Revenue Growth (yoy) | -10.20% |

Gross Profit (ttm) | 10.12M |

EBITDA | -23.9M |

Net Income Avi to Common (ttm) | -41.54M |

Diluted EPS (ttm) | -0.9400 |

Quarterly Earnings Growth (yoy) | N/A |

Total Cash (mrq) | 82.85M |

Total Cash Per Share (mrq) | 2.4 |

Total Debt (mrq) | 18.78M |

Total Debt/Equity (mrq) | 21.89 |

Current Ratio (mrq) | 7.93 |

Book Value Per Share (mrq) | 2.48 |

Operating Cash Flow (ttm) | -18.72M |

Levered Free Cash Flow (ttm) | -15.11M |

Legend: mrq = Most Recent Quarter ttm = Trailing Twelve Months yoy = Year Over Year

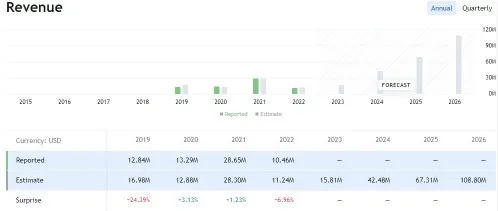

We can see from the income statement that the revenue for Zevra for the last fiscal year has been $10.46 million, while the revenue growth has been negative at -10.20%.

Although the Gross profit, i.e., Revenue minus C.O.G.S. (Cost of Goods Sold), is $10.12 million, the EBITDA or Earnings Before Interest, Tax, Depreciation, and Amortization is -$23.9 million, which indicates operational challenges.

The Total Debt to Equity ratio is also high at 21.89, which indicates the liabilities are quite high and the current revenue is not enough to mitigate them.

However, it should be remembered that they are an advanced pharmaceutical firm focused on research and development. Many of their products are in clinical trials and have not been commercially released.

Once approved, they will come into the market and increase the revenue opportunities for the firm. They are focused on developing prodrugs and creating value for their shareholders.

Although ZVRA is unprofitable, it has reduced losses over the past five years at a rate of 5.1% per year.

Let us now look at some trading information.

52-Week Change | -11.96% |

S&P500 52-Week Change | -11.27% |

52 Week High | 6.9200 |

52 Week Low | 4.0000 |

50-Day Moving Average | 5.2932 |

200-Day Moving Average | 5.2587 |

Avg Vol (3 month) | 228.7k |

Avg Vol (10 day) | 360.36k |

Shares Outstanding | 34.54M |

Implied Shares Outstanding | N/A |

Float | 31.28M |

% Held by Insiders | 10.28% |

% Held by Institutions | 17.69% |

Shares Short (Feb 14, 2023) | 1.37M |

Short Ratio (Feb 14, 2023) | 6.86 |

Short % of Float (Feb 14, 2023) | 4.00% |

Short % of Shares Outstanding (Feb 14, 2023) | 3.98% |

Shares Short (prior month Jan 12, 2023) | 1.37M |

Compared to many stocks in the stock market, ZVRA’s common stocks’ drop is not as significant as others and stands at 11.96%. Their 52-week high was $6.92, and their low was $4.

At the time of writing, it is currently trading at $4.79

The quarterly volume is 228,7000, and the number of outstanding shares is 34.54 million.

10.28% | % of Shares Held by All Insider |

17.69% | % of Shares Held by Institutions |

19.72% | % of Float Held by Institutions |

99 | Number of Institutions Holding Zevra Shares |

Some of the top Holders in the company are as follows:

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Vanguard Group, Inc. (The) | 1,402,193 | Dec 30, 2022 | 32.50% | 6,688,460 |

| Blackrock Inc. | 602,691 | Dec 30, 2022 | 13.97% | 2,874,836 |

| Laurion Capital Management, LP | 571,200 | Dec 30, 2022 | 13.24% | 2,724,623 |

| Janney Montgomery Scott LLC | 494,030 | Dec 30, 2022 | 11.45% | 2,356,523 |

| HealthInvest Partners AB | 330,000 | Dec 30, 2022 | 7.65% | 1,574,099 |

| Geode Capital Management, LLC | 309,842 | Dec 30, 2022 | 7.18% | 1,477,946 |

| Retirement Planning Co of New England, Inc. | 297,384 | Dec 30, 2022 | 6.89% | 1,418,521 |

| Mystic Asset Management, Inc. | 175,883 | Dec 30, 2022 | 4.08% | 838,961 |

| Susquehanna International Group, LLP | 170,014 | Dec 30, 2022 | 3.94% | 810,966 |

| Bank Of New York Mellon Corporation | 114,626 | Dec 30, 2022 | 2.66% | 546,766 |

Learn About:

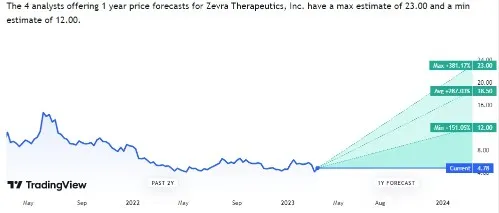

According to Tradingview, four analysts have analyzed the ZVRA stock and have forecasted that ZVRA stock price may reach $18.50 in a year, i.e., a growth of almost 287%. The maximum price is estimated at $23, and the minimum at $12.

At the time of writing, based on the analysis of the past three months, the analysts have given a Strong Buy Signal.

According to the analysts, ZVRA will see healthy growth and generate a revenue of $15.81 million in 2023, reaching $67.31 million and $108.8 million by 2025 and 2026, respectively.

Let us look at some of the points made by Simply Wall ST

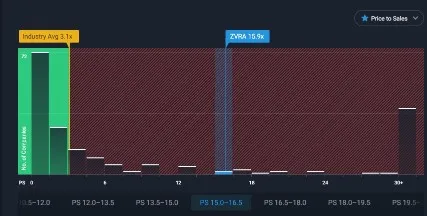

ZVRA Price to Share or PS Ratio

The Price to Share Ratio is calculated by dividing the share price by the company’s annual Revenue per Share. The PS Ratio of ZVRA stock is 15.9x

Based on the analysis, the analysts have deduced that ZVRA(15.9x) is much more expensive than its Peers, where the average is 2x.

Based on the analysis, the analysts have concluded that ZVRA(15.9x) is much more expensive than the US Pharmaceutical Industry, which averages 3.1x.

According to Simply Wall ST, the ZVRA share price ($4.79) currently trades at a discount of almost 78% from its fair value of $21.42.

According to the analysts at Simply Wall ST, the price forecast for the next 12 months is around $18.

ZVRA, the new ticker symbol of KMPH(KemPharm) after it changed its name to Zevra Therapeutics, is considered a good buy for many analysts from different firms. At the time of writing, it trades at $4.79 and is expected to grow at least 39.9% in the next three years. It is forecasted to reach $18 in a year.

KemPharm stock KMPH, now known as ZVRA, has a price target of approximately $18, with a maximum estimated high of $23 to a low of $12 in a year.

Yes, KemPharm or Zevra Therapeutics (name changed) is currently in the development phase of a couple of prodrugs and is projected to do very well by analysts across the industry. Hence, it is a good buy as the company is projected to grow at 39.9% in the next three years.

Read More:

KemPharm (KMPH Stock) had the vision to use their experience developing drugs and the technical knowledge of the regulations to transition to a company developing therapeutic drugs for rare diseases for which the treatment is non-existential.

Not only will they be able to help those in need, but this will also give them an edge and become a market leader in this pharmaceutical industry segment. It will also greatly help them to create value for its shareholders.

The company is on the right track, and if it gets approval for the drugs, then the sky is the limit for Zevra Therapeutics.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by KemPharm or Zevra. The product information may vary. Please check the company website for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any company or organization. The content is for informational purposes only. It is not financial advice. So, before investing, do your due diligence and always invest what you are comfortable losing, as all investments are your responsibility.

Share this post:

Table of Contents Rivian rose to prominence and garnered a lot of public attention in the automotive industry when it became the largest IPO or

Table of Contents Want to know about NIO Hong Kong Stock in detail? Wondering about its performance and what’s in store for NIO in the

Table of Contents Confused about MMAT and MMTLP stock? Want to know what is happening with Meta Materials? The article aims to identify the issues