Amigo Insurance Review: The Ultimate Guide

Table of Contents Do you want to know more about Amigo Insurance before you buy it? Want to delve into the details of Amigo Insurance

Are you looking for multiple insurance products like home or car insurance and wondering if Otto Insurance is the solution to your problem?

The detailed scrutiny and thorough investigation of their products and services in this article will help you decide if it is the right choice for your insurance needs.

Otto Insurance or Otto Quotes, LLC is a Florida-based aggregator of insurance companies that collects information from clients via an online form or telephonic conversation and then suggests them insurance companies with the most affordable insurance premiums best suited to their needs and range of coverages.

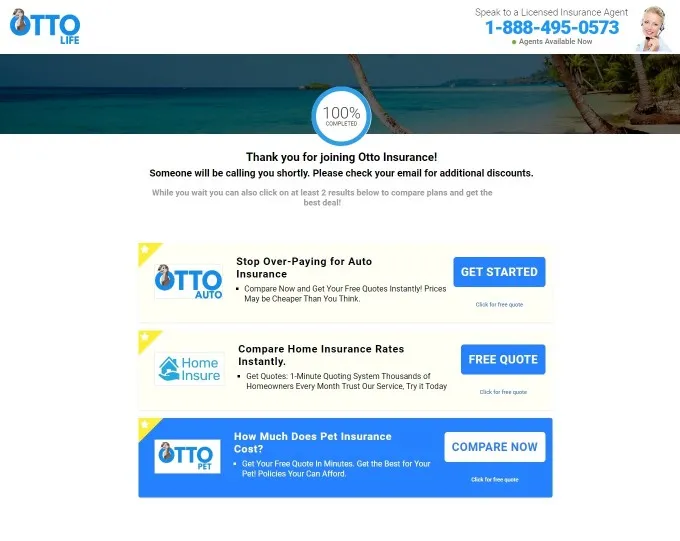

Their primary focus is on Auto Insurance, but it provides a wide variety of insurance products and services apart from Auto Insurance which includes Pet Insurance, Home Insurance, Life Insurance, and Commercial Insurance. It is a one-stop solution for customers looking to purchase insurance in multiple verticals through an effortless and seamless insurance booking process.

However, Otto Quotes, LLC is not a licensed Insurance issuer, i.e., they are not an independent agency underwriting insurance or handling the claims process for the clients. They do not offer any insurance products or services directly to the clients.

Their primary focus is collecting specific information from the clients to understand what kind of insurance they are looking for and what kind of coverage they might need. The best options are presented to them based on the location and the specific criteria.

The insurance company quotes depend on various factors such as the level of coverage chosen, deductibles, driving records, credit score, type of vehicle, location, and various other variables. Even driver discounts are based on experience, safety training, safe drivers, etc.

Note: Otto displays the most affordable rates through their matching algorithm. They are the lowest rates per their research from the list of insurance companies in their database, but they may not be the lowest rates available in the market. There is a possibility companies are offering lower rates for the related insurance product compared to the ones displayed by Otto.

It has been observed that most legit companies have a physical office and a working telephone number, and Otto Insurance seems to have a physical office at 25 SE 2nd Ave Ste 550 PMB 177, Miami, FL 33131, and a working phone number, 1-888-596-1534.

They are a service-based organization that makes getting insurance in a wide range of domains easier and smoother for customers. They just need to visit the site and answer a few questions, and the best full-service agencies with the most competitive rates will be displayed for them. They can simply proceed with the suggested companies, get the quote and buy them if their needs are fulfilled.

Their website also has dedicated pages on Privacy Policy and Privacy Rights where they have clearly mentioned how the information collected in the form through the customers is to be used.

BBB and Reddit also showcase positive reviews regarding Otto Insurance and its level of service. They have not been identified as a scam by authoritative agencies, and no one has accused them of being a part of any fraud to date.

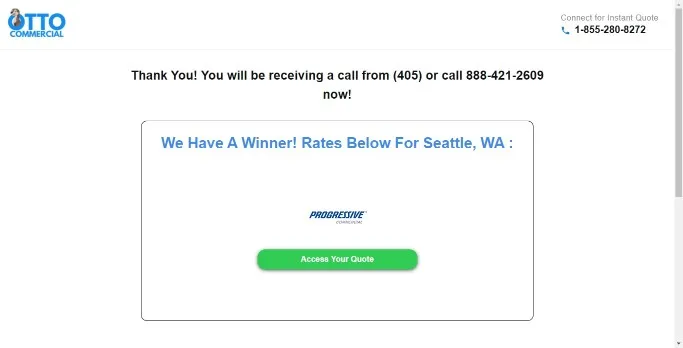

Since they are not a licensed insurance agency, they share the information collected with major insurance providers who may send texts or emails or make numerous calls to offer their services. It ensures they run a proper affiliate program partnering with many insurance companies such as Progressive, Allstate, Nationwide, etc.

Based on all the information, the inference can be drawn that Otto Insurance is legit.

Otto is an independent, full-service insurance agency providing Insurance coverage in multiple verticals. However, their primary focus is on Auto Insurance, and the most common auto insurance coverages included are as follows:

If there is a bodily injury (where the insured client was driving the car and caused injury to another person) or property damage (someone else’s mailbox is hit by the car of the insured person), then the Liability Insurance Coverage (bodily injury liability and property damage liability) offers protection against them. Minimum Liability Coverage is a mandatory requirement in 49 of the 50 states and carries a penalty if it is not included in the insurance policy.

Collision Insurance Coverage offers financial protection against losses incurred when the insured person’s vehicle collides with another vehicle or other objects such as telephone poles, guardrails, or lampposts. It is highly recommended, especially to drivers whose cars are leased or financed, where the lenders or the financers make it a point to make it a mandatory requirement. It may be avoided only in the case of an old car where the cost of repair or replacement is not worth it. The premium rates may vary depending on how high or low your deductible is.

Apart from collision, Any losses to your vehicle, such as theft, natural disaster, etc., are covered by the Comprehensive Coverage. Using a leased or financed car is highly recommended, as the lenders may make it mandatory to be included in your insurance policy. It can be avoided for old cars where it’s not worth it. The premium rates can vary depending on the level of deductibles.

PIP covers the medical costs and lost wages (in some cases), and any other damages that the policyholder and other passengers may face when they meet with an accident. People may avoid this coverage if they already have good health insurance coverage or disability coverage, and even some states allow not to include this coverage in auto insurance policies.

Medical Coverage covers all the costs associated with medical expenses, hospital costs, or any other health-related costs that may arise from a car accident. It is usually included in the PIP Coverage. It may be avoided if the policyholder already has excellent medical/disability insurance. Some states also allow users to waive them in their insurance plans. Contact the insurance agents for detailed suggestions.

If an accident occurs and the other driver is at fault and if that driver is uninsured or underinsured, this coverage will cover the financial costs associated with the medical costs and any other damages that may occur due to the accident. The insurance company pays the bills and recovers them from the other at-fault party, i.e., the uninsured driver.

If a car has been bought by financing it through a finance company and the car, unfortunately, meets with an accident and is completely totaled, then this coverage will pay for the amount left on the car loan. In some cases, auto insurance providers may not pay the remaining loan amount due to various factors such as payment deferrals, late payments, etc. Understanding the coverage’s minute details and working it out with the insurance company beforehand is essential.

If your car is being repaired as part of a covered claim, then this coverage will reimburse you for the transportation expenses as per your limit. It will not cover the expenses if your car has gone to the repair shop for routine maintenance.

This coverage pays for all the service costs related to a breakdown and the roadside service. It will cover the labor expenses, including the driver of the towing service and any other associated costs to tow the car to the nearest service station. It will also cover the cost of services such as tire changes, gasoline delivery, oil, or any other parts. However, the cost of the parts is not included in usual cases.

No-Fault Auto Insurance covers the cost of an accident, be it damages or medical expenses, without considering who is at fault. The policyholders are quickly paid for the bills related to health and damages, but the premium charged is much higher as they become high-risk clients. Some states, such as Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah, have no-fault auto insurance laws.

Pay-As-You-Drive Insurance offers a cost-efficient alternative to standard auto insurance if the policyholder doesn’t drive the car as much. The cost of the policy depends on the number of miles driven. Usually, a GPS is installed, or the vehicle owner has to manually report the odometer readings to determine the number of miles the driver has driven. Based on that, the insurance rates are determined.

An SR-22 form is required by the DMV when you have been involved in an uninsured car accident or have committed an offense related to severe traffic violations. Once this coverage is taken, the insurance company informs the DMV that you have the liability coverage to offer protection in case an accident occurs in the future. Users may also opt for non-owner insurance coverage for SR-22 if they want to reinstate the license but do not own a car. If the policyholder cancels the SR-22 or if it is expired, the insurance company is bound by law to report it to the DMV.

Easy Process to Save Time

Finalizing an insurance company requires a lot of research and knowledge about the domain. Hence, people who don’t have time can take advantage of the easy process to fill out the form, get hold of the best insurance companies, and generating quotes within a few minutes, saving valuable time.

Multiple Insurance Products on One Platform

Otto provides insurance services in multiple verticals, including auto, home, life, pet, and business insurance. It is a huge relief for most consumers as they don’t have to run to multiple insurance websites and find all the solutions in one place. It is of great help to first-time insurance buyers who usually need to learn more about the field.

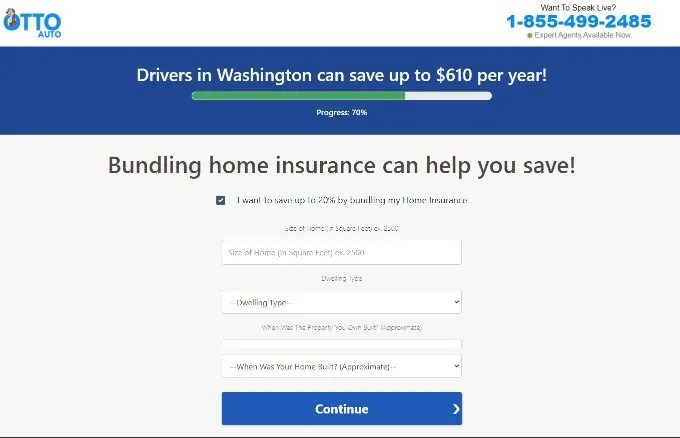

Bundled Offerings

As they are a full-service agency ready with a referral program offering insurance in many domains, they can easily offer bundled insurance offerings to the clients. For example, suppose they are collecting information about car insurance and finding out the client is a homeowner. In that case, they may offer home insurance bundled with car insurance offerings, which further streamlines the process of getting different types of insurance and can significantly help the clients.

Comparison of Insurance Rates and Coverages

With the help of Otto Insurance which has deep roots in multiple verticals, a list of the best options for you is presented depending on the information you have provided. So, instead of googling and finding out about the rates and finding out which one best suits your needs, you can easily compare the rates and coverages through the quotes provided by the insurance companies, as suggested by Otto.

Access to Local Insurance Agencies

Otto partners with insurance agencies from all localities and makes it a point to suggest insurance agencies best suited to your needs specific to your locality. It is an excellent add-on, as you could have overlooked these local players while conducting your research manually.

Obligation Free Service

Users using Otto’s service are not obligated in any way to buy insurance policies. It is a free-to-use service that the clients may use to get a free quote from the suggested companies and buy them eventually if it suits their needs or just use the quotes as information and perform no other action.

Expert Consultation

In case you are not comfortable sharing information online via the forms and want a more direct approach, then you can take advantage of their live consultation through phone calls where expert advisors are available to discuss your insurance needs and coverage options and then offer the best competitive policy options according to your needs.

Limited Insurance Firms

They have a database of a limited number of insurance companies. Their server cannot accommodate the hundreds of insurance agencies available in the market. Hence, it’s an opportunity cost for the clients as they do not have access to those companies which are not included in their matching algorithm.

The lowest Offers May Not Be Displayed.

It is possible that the offers that are shown, although affordable, are not the cheapest or the lowest ones in the market. As all the companies available in the insurance industry are not considered when your requirements are matched, it is quite possible that the offers shown by them are not the lowest.

Disadvantages of No Self Research

Otto makes the entire system of getting any kind of insurance effortless. Still, it lacks in one department, i.e., fully understanding the needs of the customer and the coverages it may require. It has a set pattern of fundamental questions in an online form that collects some personal information and then shows the related insurance firms. In contrast, if you conduct your research, the companies you will find will match your coverage needs and budget much more accurately.

Confusion about Otto’s Insurance Business

Otto is not an actual insurance company. It is essentially a tech company that uses technology to match the user information with the affiliate insurance companies based on their matching algorithm and then showcases the result to the users. Although it is an aggregator, the terminology often confuses users about what business Otto is into.

To get the best auto insurance rates and auto insurance discounts from Otto Insurance, follow the steps:

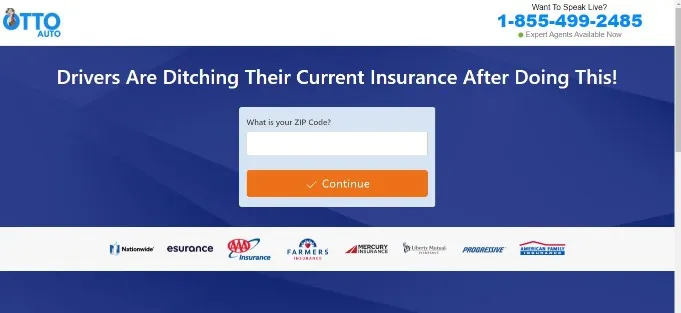

1. Visit the Otto Insurance homepage and click on “Auto.”

2. Enter your Zip Code in the “What is Your Zip Code?” box and click “Continue.”

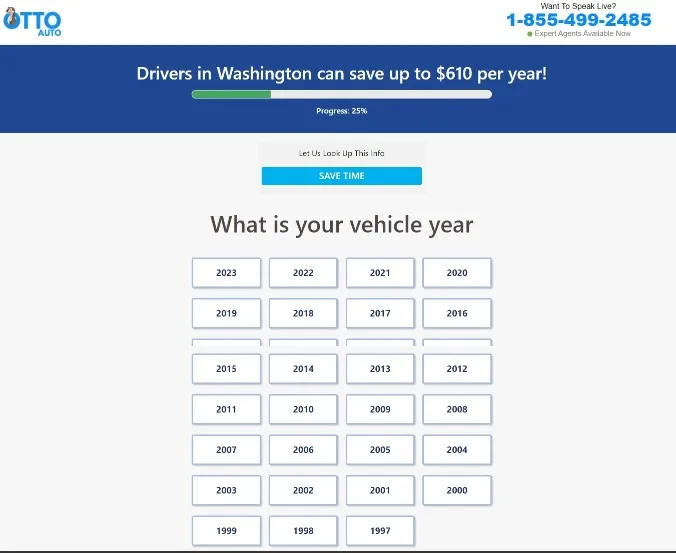

3. Choose the Vehicle Year.

4. Choose your Vehicle Make

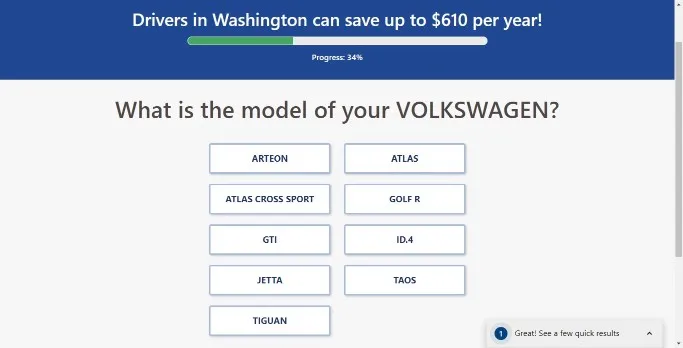

5. Choose your Vehicle Model

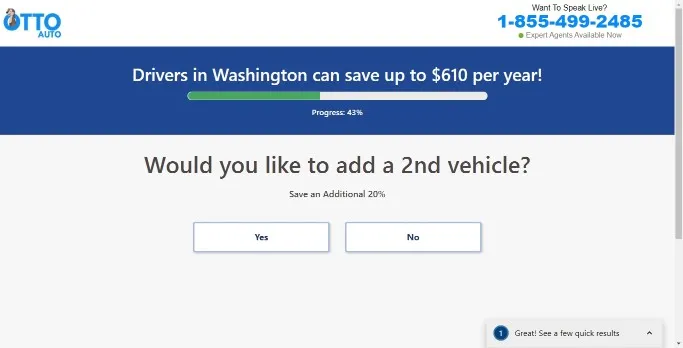

6. Choose “Yes” or “No” to add a second vehicle.

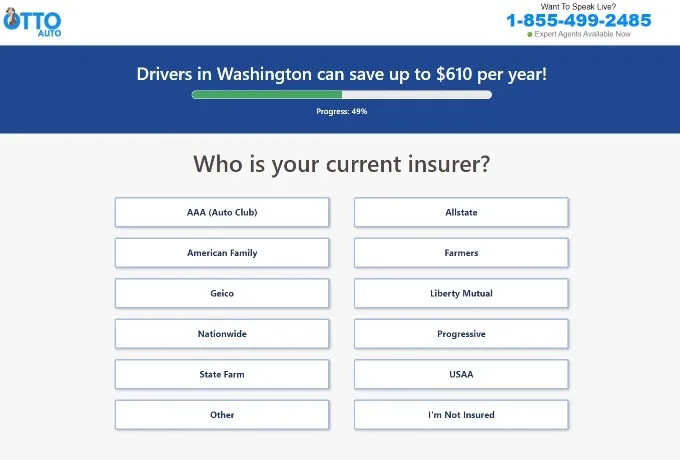

7. Choose your current Insurance Issuer or “I’m Not Insured” if you don’t have car insurance.

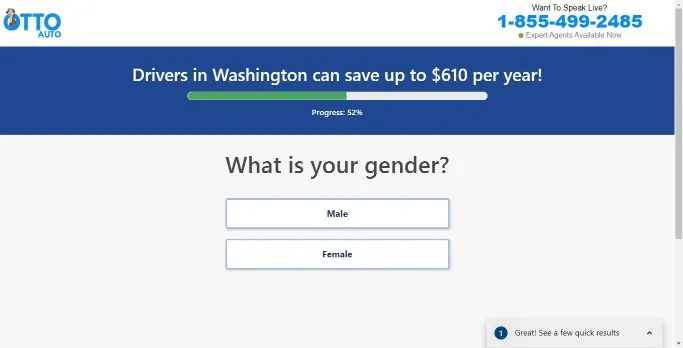

8. Choose your Gender

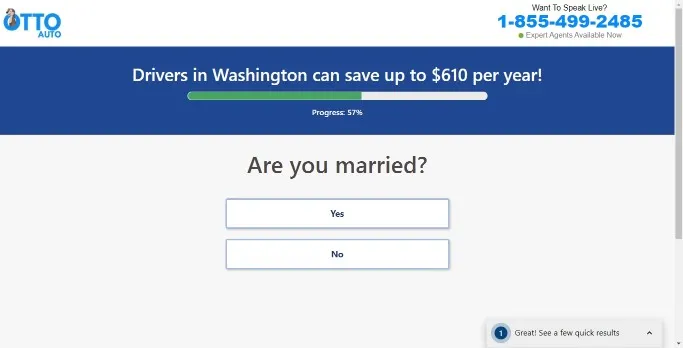

9. Choose your Marital Status

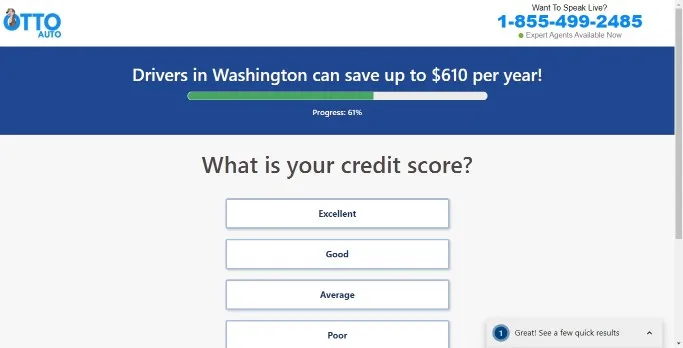

10. Choose your level of Credit Score.

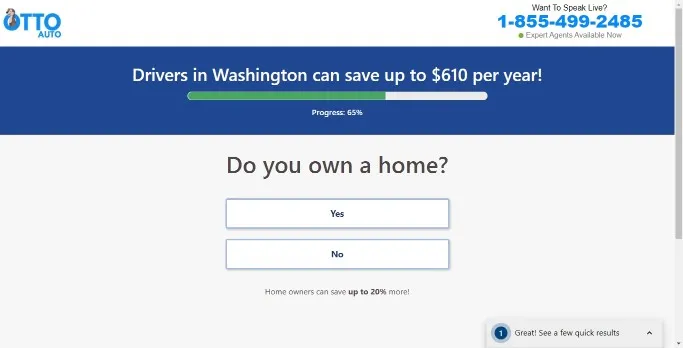

11. Choose “Yes” or “No” if you own a home.

12. Choose if you want to opt for a bundling offer of home insurance along with your auto insurance. (Renters Insurance is offered if you have chosen that you don’t own a home.)

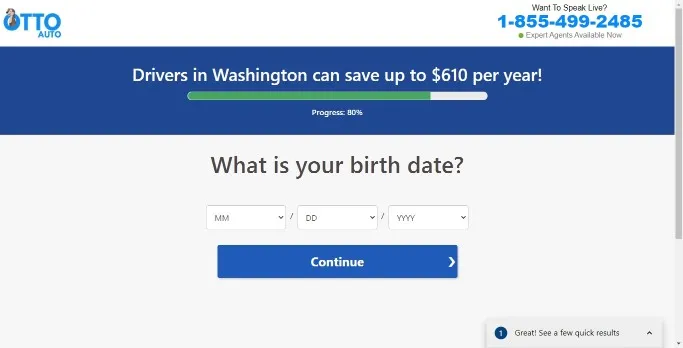

13. Enter Date of Birth

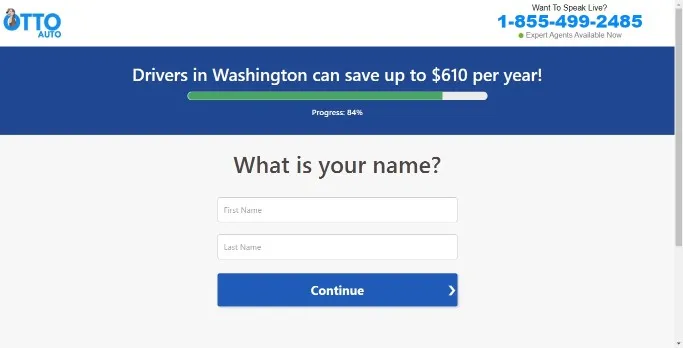

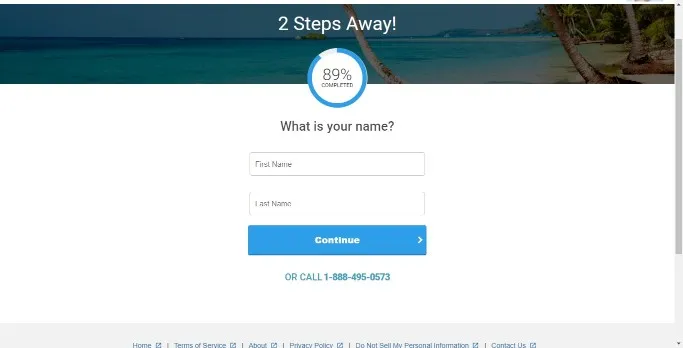

14. Enter your First and Last Name

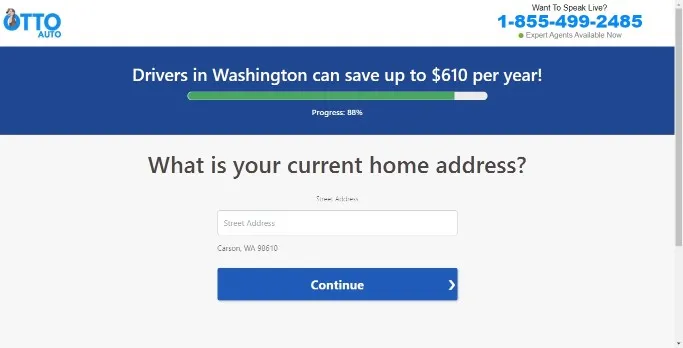

15. Enter your Address

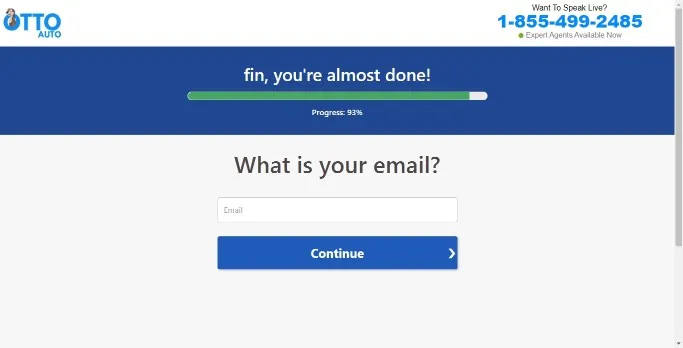

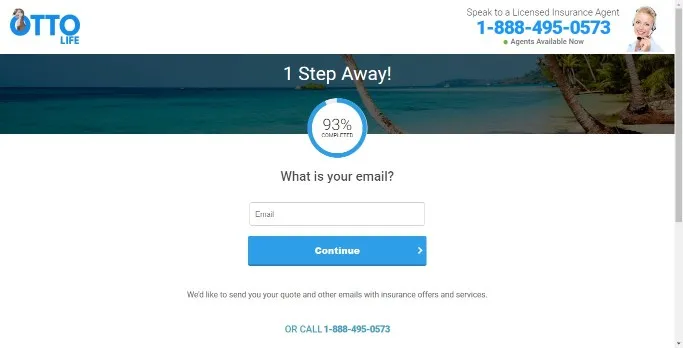

16. Enter your Email

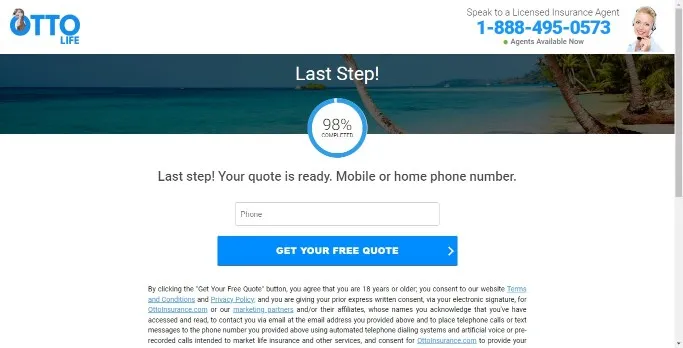

17. Enter Your Number

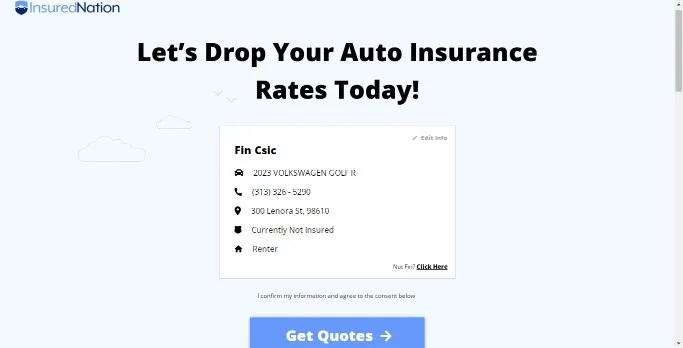

18. Select from the suggested Auto Insurance Companies list, which leads you to the insurer’s page. Then continue the process to get the quote and finally decide whether to buy or leave it.

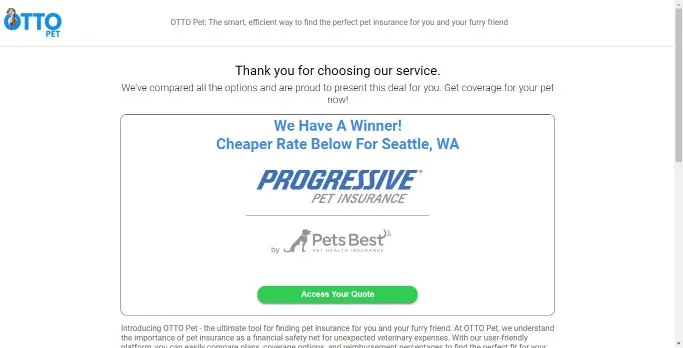

To get the quotes for Pet Insurance, follow the steps:

1. You need to visit Otto Insurance Home Page and click “Pet.”

2. Select the low-cost car insurance option you like and continue the process on the insurer’s website to get the quote and then buy it or leave it.

To get the best auto insurance rates and auto insurance discounts from Otto Insurance, follow the steps:

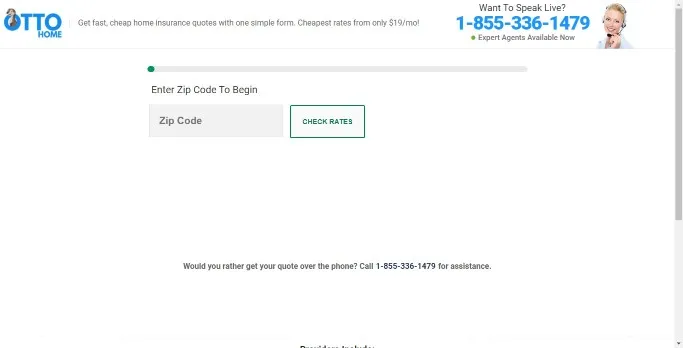

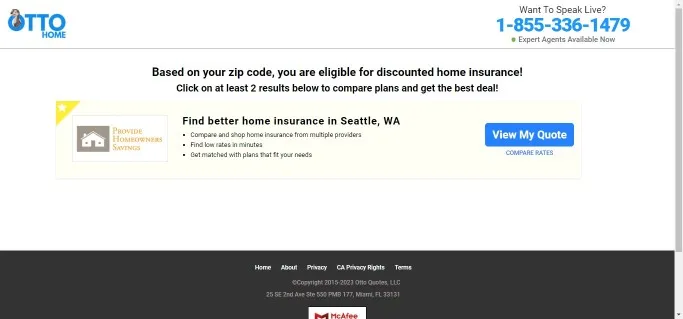

1. You need to visit Otto Insurance Home Page and click “Home.”

2. Enter Zip Code and Click “Check Rates”

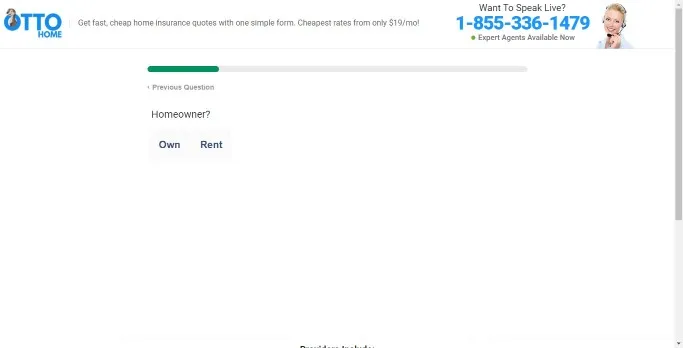

3. Select “Own” or “Rent” that is relevant to you.

4. Select “Own” or “Rent” that is relevant to you.

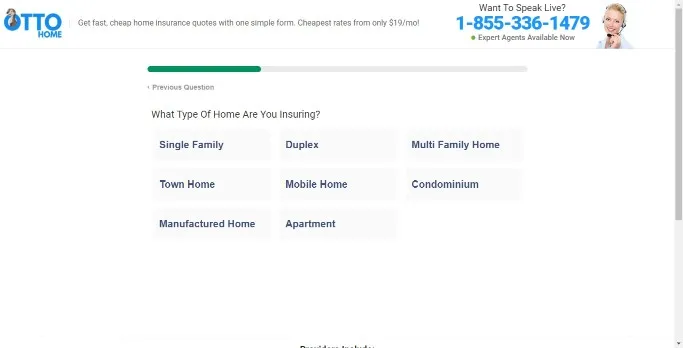

5. Select the Type of Home you want to insure

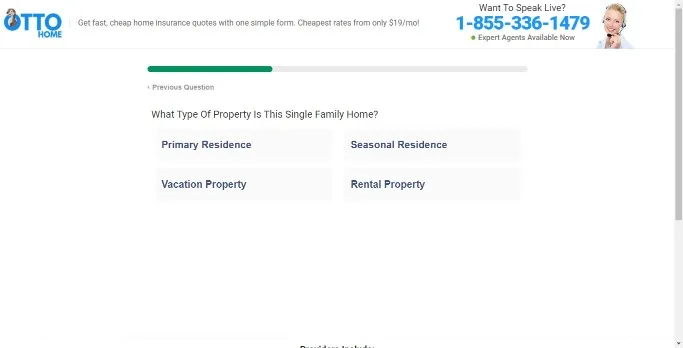

6. Select the Type of Property

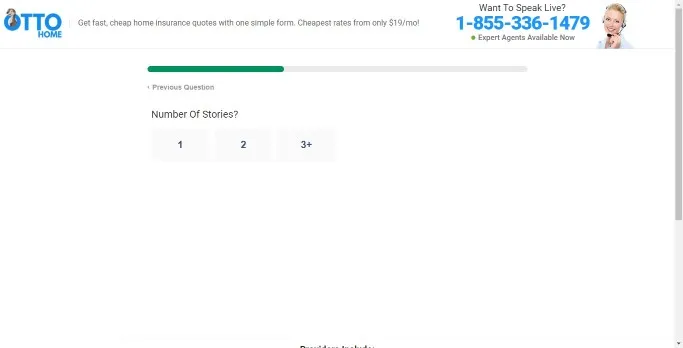

7. Select the Number of Stories

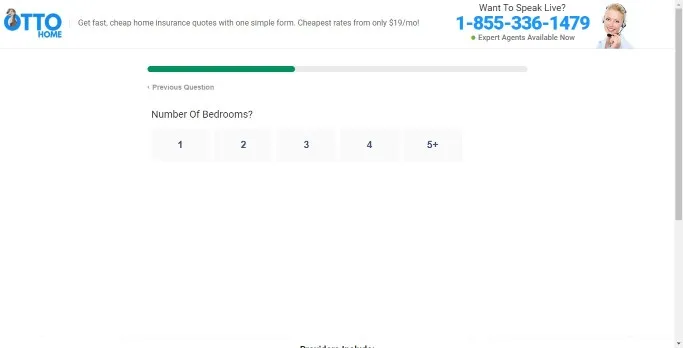

8. Select the Number of Bedrooms

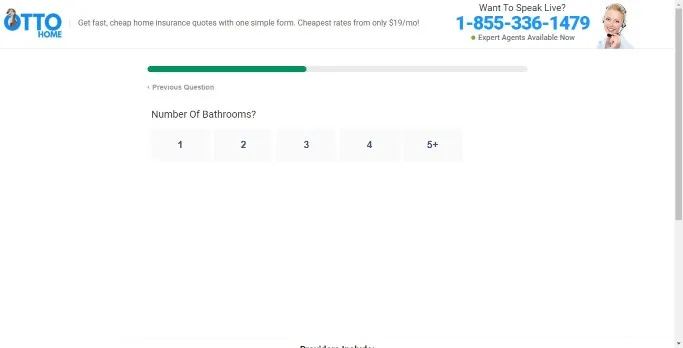

9. Select the Number of Bathrooms

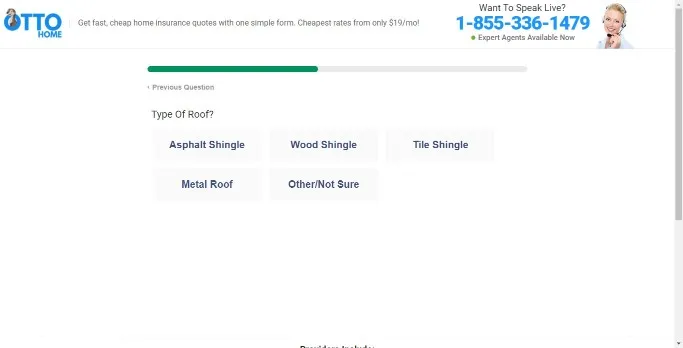

10. Select the Type of Roof

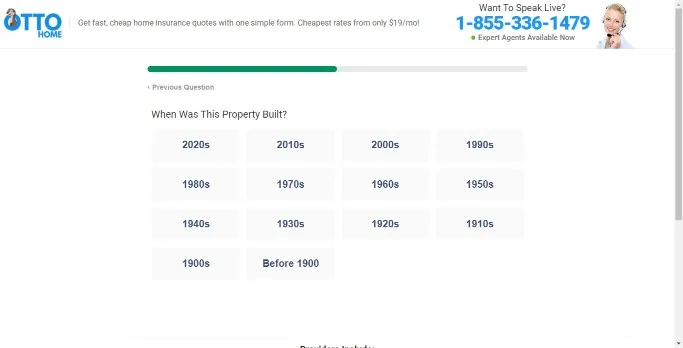

11. Select the Time when the Property was built.

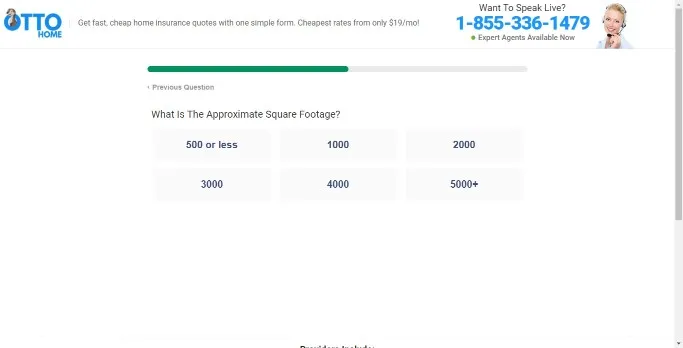

12. Select the Approximate Square Footage of the Property.

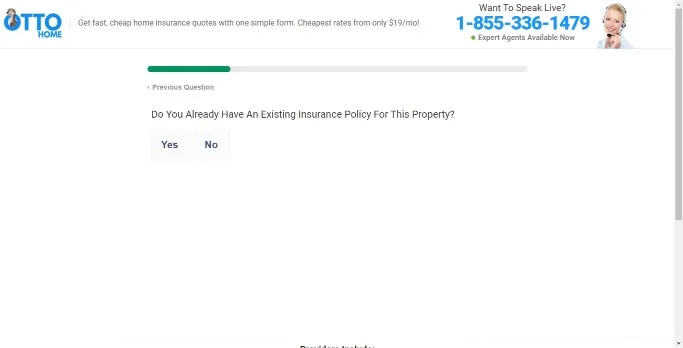

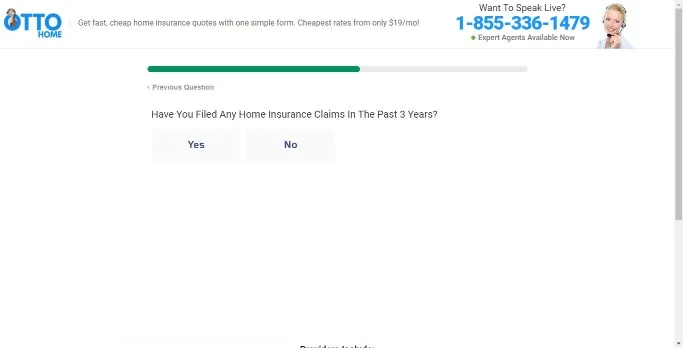

13. Select “Yes” or “No” to determine whether you have any Home Insurance Claims in the past three years.

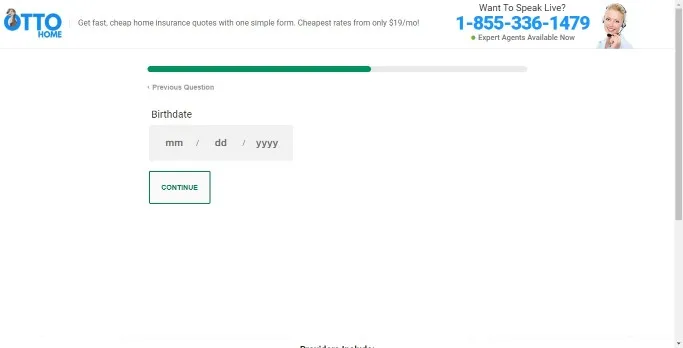

14. Enter your Date of Birth

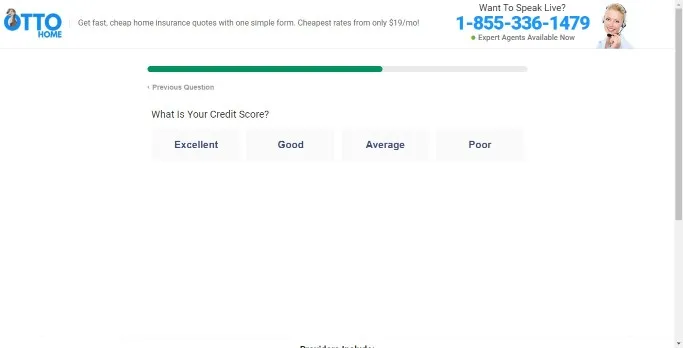

15. Select your Level of Credit Score.

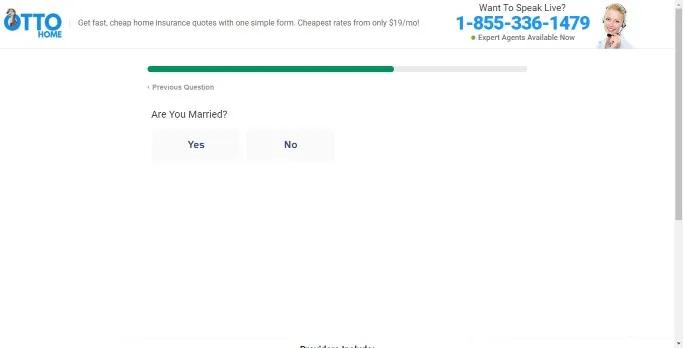

16. Select whether you are married or single.

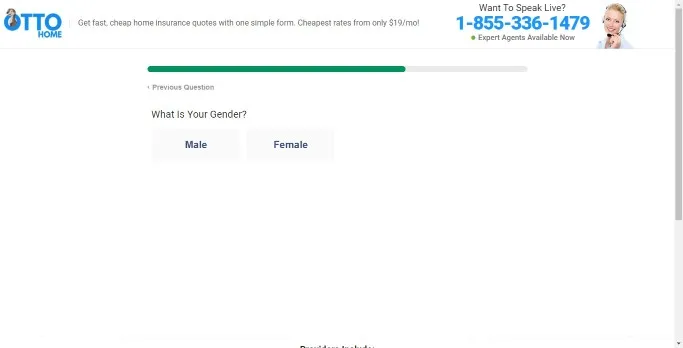

17. Select your Gender.

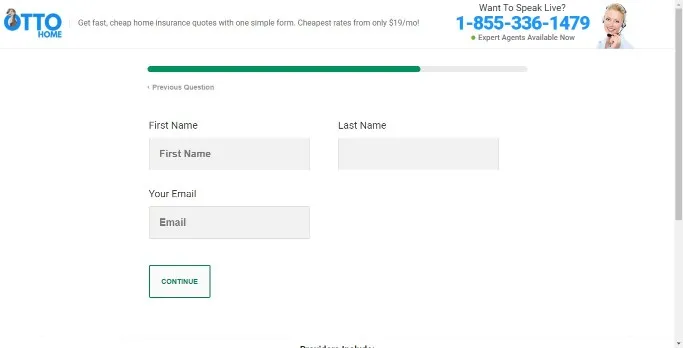

18. Enter your First and Last Name and Email

19. Select “Yes” or “No” to bundle Auto Insurance with Home Insurance.

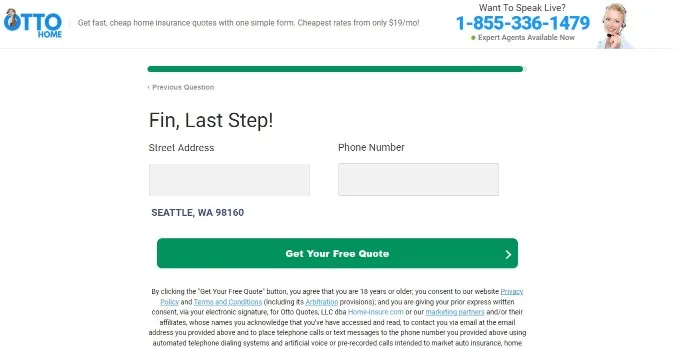

20. Enter your Address and Phone Number

To get Life Insurance Policy Quotes, follow the steps:

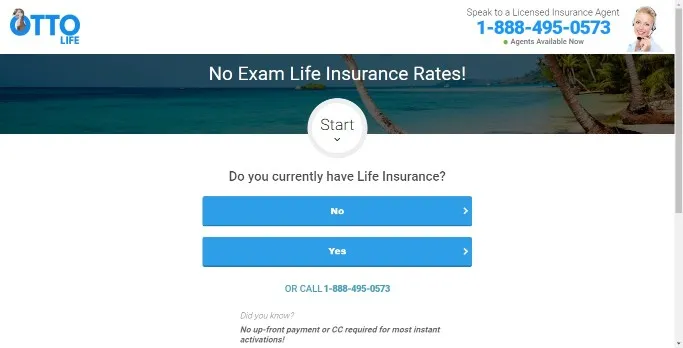

1. You need to visit Otto Insurance Home Page and click “Life.”

2. Select “Yes” or “No” to determine your current life insurance policy.

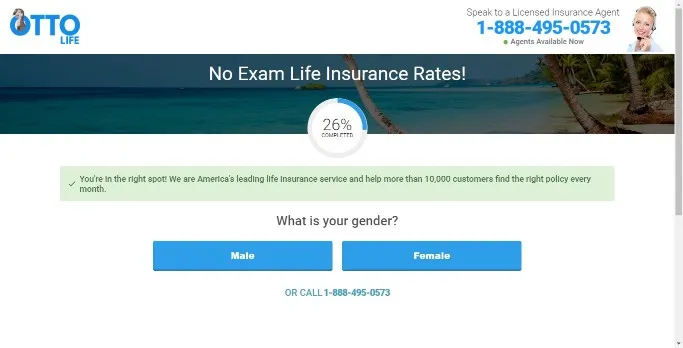

3. Select Your Gender.

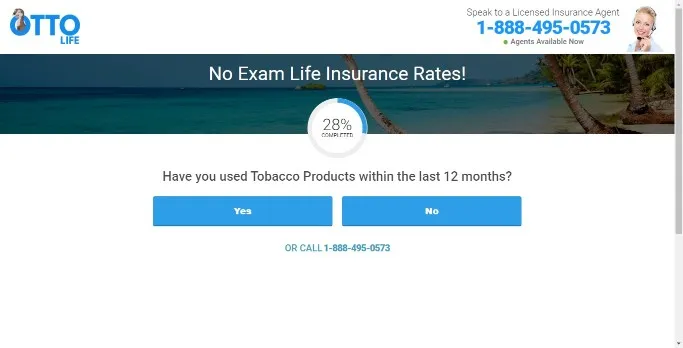

4. Select “Yes” or “No” to determine whether you have used any Tobacco Product in the last 12 months.

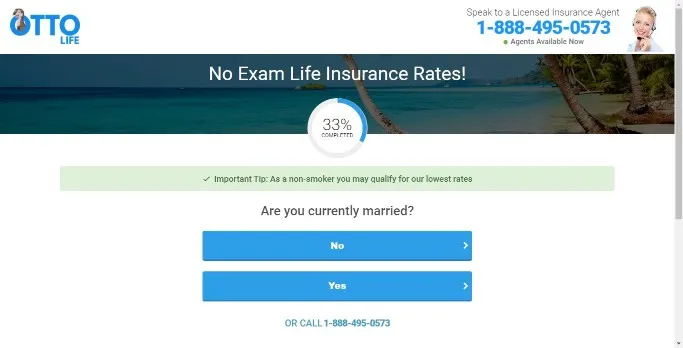

5. Select whether you are married or single.

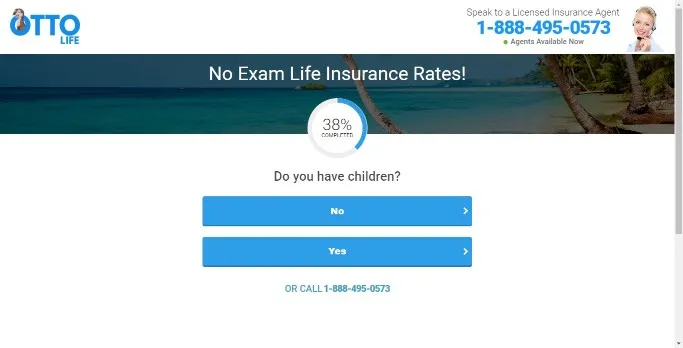

6. Select “Yes” or “No” to determine whether you have any children or not.

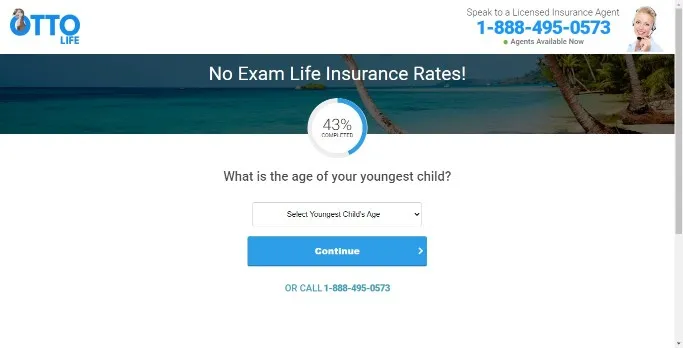

7. If you selected “Yes” to the previous question, enter your youngest child’s age and click “Continue.”

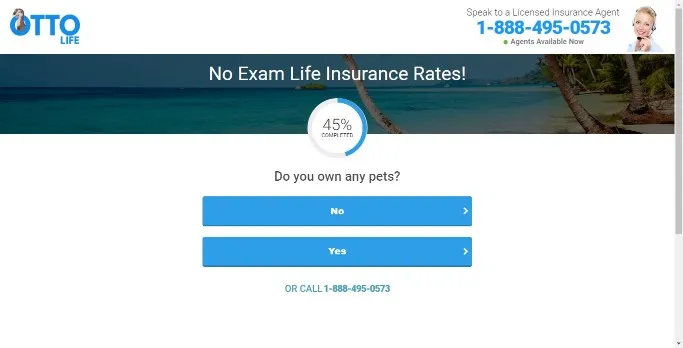

8. Select “Yes” or “No” to determine whether you own pets.

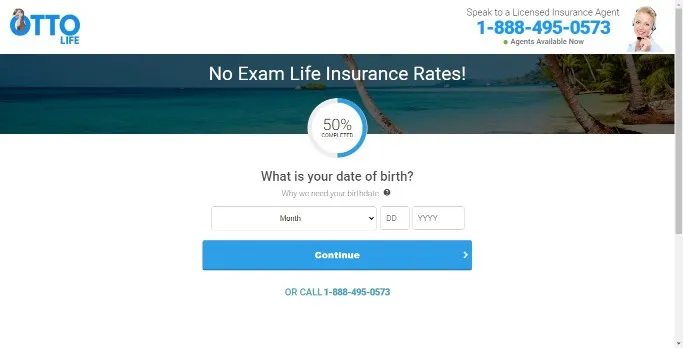

9. Enter your Date of Birth and click “Continue.”

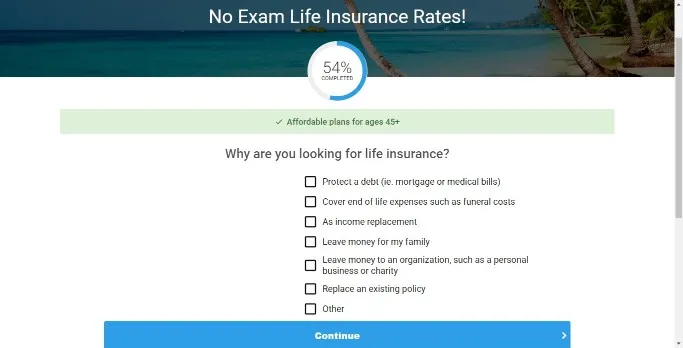

10. Check the Insurance Coverages you want to add to your policy.

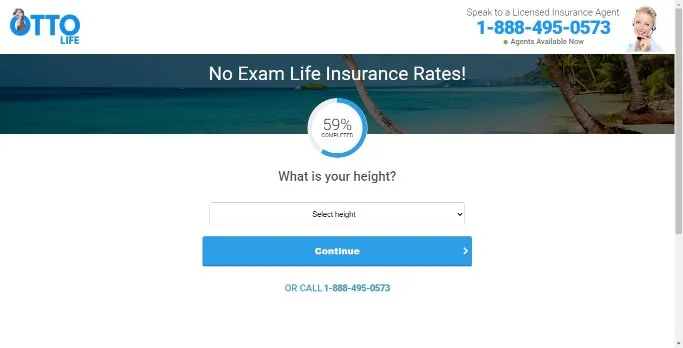

11. Select your height from the dropdown menu.

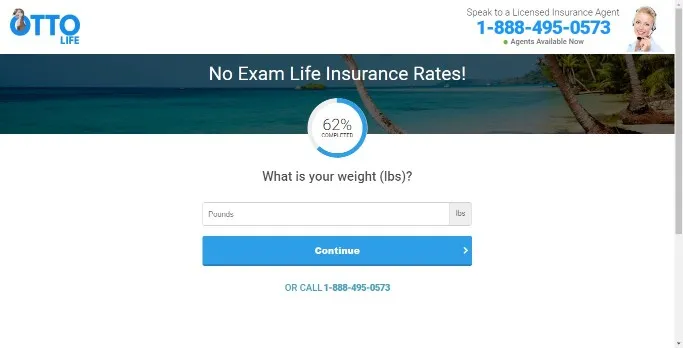

12. Enter your weight (in lbs) and click “Continue.”

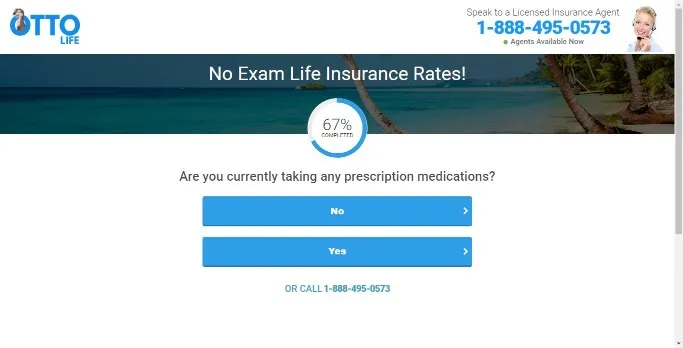

13. Select “Yes” or “No” to determine whether you are on any prescription medications.

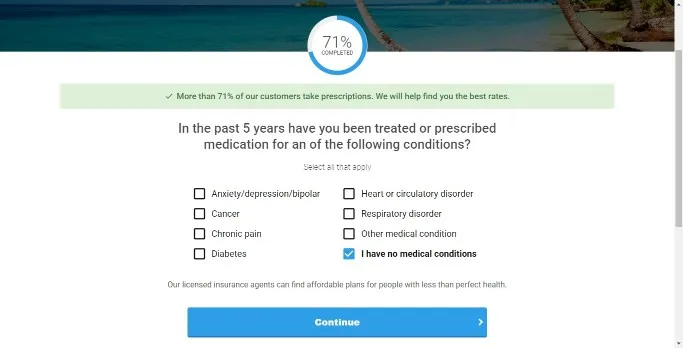

14. Check the diseases you have been treated for in the last 5 years. Check “I have no medical conditions” if you have not been treated for any diseases and click “Continue.”

15. Select your Employment Status

16. Enter your Address

17. Enter your First and Last Name and click “Continue.”

18. Enter your Email and click “Continue.”

19. Enter your mobile number and click “Get Your Free Quote.”

20. Select the life insurance company that suits you from the list of suggestions and then continue on the insurer’s website, get the quotes, and then buy or leave them.

To get Homeowners Insurance Policy Quotes, follow the steps:

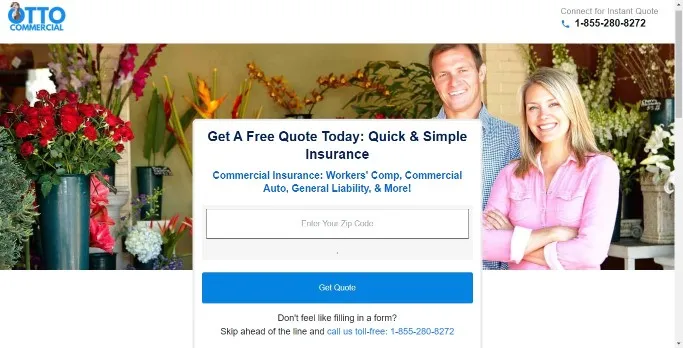

You need to visit Otto Insurance Home Page and click “Commercial.”

1. Enter your Zip Code and click “Get Code.”

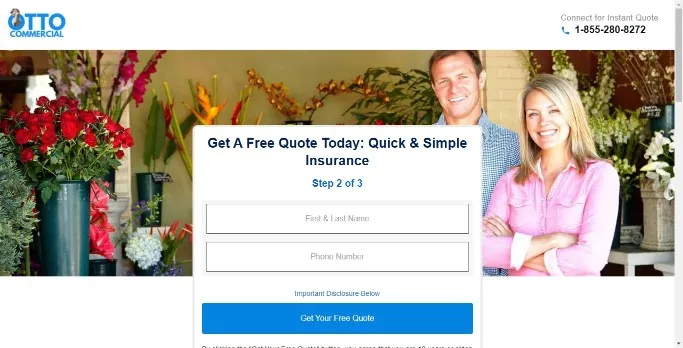

2. Enter your First and Last Name and click ” Get Your Free Quote.”

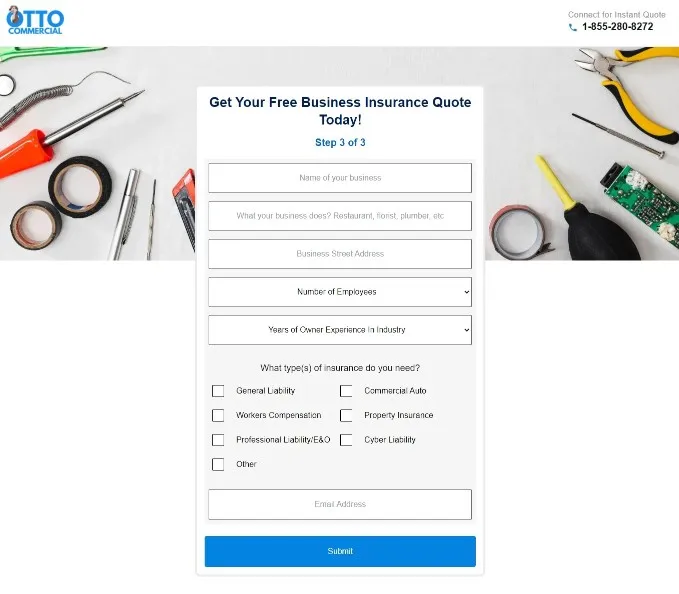

3. Fill up the form by entering the following info and then submit it:

4. Select the Home Insurance Option and then proceed to the Home Insurance company’s website to continue the process to get the quote and then either buy it or leave it.

The purchasing process to buy the Insurance from Otto Insurance is as follows:

Step 1. Choose the Type of Insurance you want (Auto, Pet, Home, Life, or Commercial)

Step 2. Enter the information as asked step by step through the online forms.

Step 3. Select the best option from the suggestions list based on the provided info.

Step 4. Continue to the Insurer’s website to complete the process to get the actual Quote.

Step 5. Make Payment to buy the Insurance.

Note: Alternatively, you can call the insurance specialists at their live consultation number 1-888-596-1534 to describe your coverage needs and budget and then get the best insurance companies as suggestions which you can decide to buy afterward.

You can contact Otto Insurance via Phone or Email. They are as follows:

Phone Number: 1-888-596-1534 – Call this number to get ahold of expert insurance advisors to guide you through the process of getting a quote from the relevant insurance companies.

Email: [email protected] – For any insurance-related concerns or insurance-related queries.

Joshua Keller is the owner of Otto Insurance.

Otto Insurance is an Insurance aggregator, so its competitors include NerdWallet, Insurify, EverQuote, Policygenius, etc. It is currently ranking 89th among 341 active competitors.

Otto Insurance, the Insurance Aggregator and Referral Program Company, has been in business since 2015.

Read More:

Otto Insurance is an independent agency providing insurance services. It is a technology-based service company meant for those who don’t want to spend hours researching what insurance to get.

It uses its technological prowess to collect the necessary information from the clients to understand their insurance needs and the coverage options they need.

It then uses its matching algorithm with all the insurance companies they are partnered with as affiliates and provides the best suggestions among them to the client.

It has a significant advantage as a one-stop solution for clients, especially those looking to buy multiple types of insurance.

However, it is better to conduct your own research if you have ample time to find out the lowest rates available in the market according to the coverage needs you may have.

But, if you want a quick and effective solution without much effort, then Otto Insurance is the way for making an informed decision.

For a more personal touch and better customer satisfaction with requirements suiting your needs, you can even use their expert consultation to get more customized suggestions.

Based on the suggestions, proceed to get the quotes and finally buy the insurance policy if you feel it matches your coverage options and budget.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Otto Insurance or any of its partner Insurance Companies. The product information may vary. Please check the issuers’ websites for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any insurance issuer. The content is for informational purposes only. It is not financial advice.

Share this post:

Table of Contents Do you want to know more about Amigo Insurance before you buy it? Want to delve into the details of Amigo Insurance

Table of Contents Are you looking to buy insurance for your motorcycle? Have you heard of Harley David Insurance but are unsure whether it is

Table of Contents Want good insurance for your vehicle? You have heard about Karz Insurance but are still determining whether it is the best fit