What Companies are in the Finance Field? -Top 15 Finance Companies

Table of Contents Bloomberg once stated that the present-day economy relies heavily on the finance industry, vital support, and resource for businesses to flourish by

Hey! Do you want to invest in AMC, GME, or BBBY? You have responded to your inner call of taking advantage of the lifetime opportunity of investing in these companies following the trend, but do you need help figuring out where to start? Do you need more information on them?

Well then, worry not because Stonk-O-Tracker is here. It is a one-stop solution providing information about American Entertainment Holdings or NYSE: AMC, GameStop or NYSE: GME, Bed Bath and Beyond, or NASDAQ: BBBY.

The tracker may seem like a new language to the uninitiated, but don’t worry; our guide is here.

This guide will explain the details of the tracker, and after reading it, you will be familiarized with all the different terms and features of Stonk O Tracker.

An unknown developer, most probably a Redditor, invented this valuable tool because of his liking for stocks; he even says on the website, “I just like the stock.” Be it AMC or GME, they are all meme stocks and garner much traction from communities.

Name of the Tracker | Stonk-O-Tracker |

Developed by | Unknown Stock Enthusiast |

What does the tracker do? | It is an online tool that tracks and collates information about specific stocks and presents them in a dashboard format. |

Stocks Tracked | AMC, GME & BBBY |

Features Available |

|

Sources of data |

|

These stocks are immensely popular and are regularly discussed on Reddit, Twitter, or YouTube. This developer saw a lot of potential in the discussion and thought a tool might help the average investor make a more informed decision about investing in these stocks.

As a result, he developed Stonk-O-Tracker. The tracker includes various information, including the current NYSE price of the stock, Short Sale Restriction of the threshold of shorting stocks, Trading Volume, Borrowed ETD shares, Options Data, and the newly added Tits-Up-Tracker.

The website provides a basic interface with all the data in different tabs. The information regarding a particular stock can be accessed via the “Stocks” drop-down category on the main menu.

Do you need clarification on all these terms? – Don’t worry; follow our guide, and you’ll become well-versed with all of them. We will be explaining the terms taking AMC as an example.

So, as we go to the homepage and select AMC from the drop-down menu of Stocks, a dashboard is seen with various information. The details are laid out in this section.

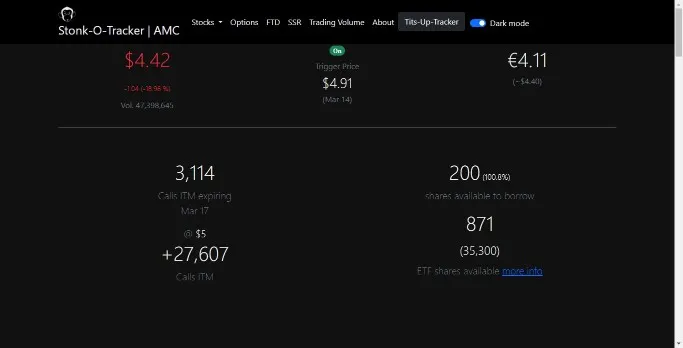

The first thing that you will notice on the leftmost side is a dollar value. For example, we can see the value of $4.42. This dollar value represents the actual price of the AMC stock on the NYSE. It also indicates the percentage change since the last day’s closing price and the volume traded. There is a dedicated page for the trading volume as well.

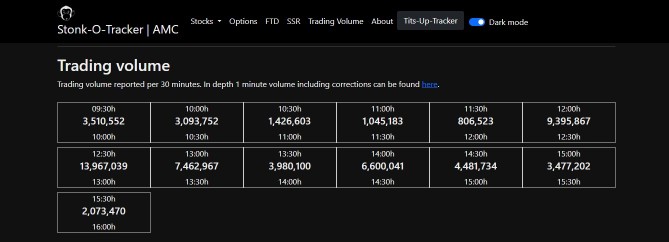

The Trading Volume section on the homepage shows the in-depth 1-minute volume, including the corrections updated every 30 min.

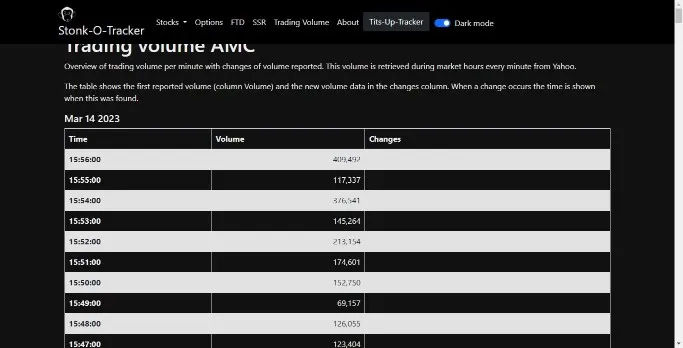

The dedicated trading volume page collates the volume of shares that are being traded. The volume change is captured every minute and then shown in a tabular format. The time when the volume changes are recorded and displayed in the table.

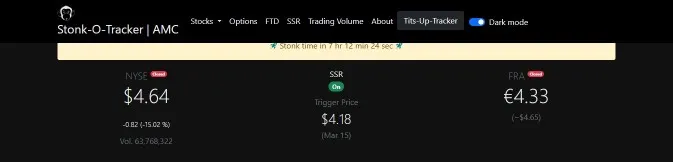

In the middle of the page, you can see a ticker, “Stonk Time in,” with a timer. For example, here we can see that it says, “Stonk Time in 7hr 12min 24 sec”. It means the NYSE is closed, and the market will open in 7hr 12min and 24 sec.

In the middle, we can see the option SSR with a dollar value. There is an on/off indicator on the top, and above the price is a label called “Trigger Price,” and below the price, it indicates the current date.

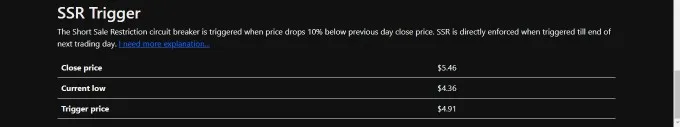

SSR is the abbreviation of the term “Short Sale Restriction.” It is a rule set by SEC for any stocks on NYSE to stop short selling during a downtick. It automatically triggers if the stock price falls below 10% from its closing price on the previous trading day.

Some applicable conditions are as follows:

This circuit breaker ensures that short sellers cannot continuously short the stock and drop the price so low that it will hurt the investors. This mechanism is placed as a threshold to protect the investors and cause a huge panic. It will also ensure the resulting shorting cannot lead to a bank run.

For example, as we can see in this case, the SSR trigger price is set at $4.91. It has been set to $4.91 because the previous day’s closing price was $5.46, so keeping a 10% threshold, it comes to $4.91.

Interestingly, we see an “on” symbol above the SSR, which means NYSE has triggered the SSR, so people won’t be able to short AMC continuously during today’s trading hours. It is also verified that the stock price shows a price of $4.42, which is lower than $4.91.

SSR doesn’t restrict traders from shorting but puts a rule in place.

So, with the SSR in effect, the stock should go: sell (downtick), buy (uptick), sell (downtick), buy (uptick).

On the right-most section, we can see the Euro value with an equivalent USD value below it in brackets.

Just like in the leftmost section, it shows the price of the AMC stock in Europe’s largest stock exchange, Börse Frankfurt or Frankfurt Stock Exchange of Germany.

As we can see in our example, the Euro value is shown as €4.11, and the corresponding USD value of $4.40 is mentioned below.

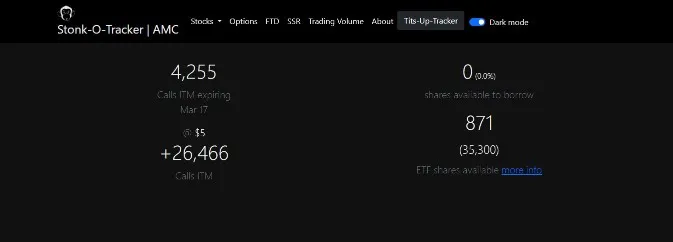

Stonk-O-Tracker provides an option called Calls ITM Expiring in the top dashboard section.

It indicates how many AMC call options expire “In The Money” on a specific date.

An option call or a call enables users to buy a particular share at a set price on a specific date, also known as the “Strike Price.” So, a buyer speculates the stock price based on research and intuition.

So, when the date of the options expiry comes to fruition, if the price at which the call was set is lower than the actual price of the stock on that day, then the trader is “in the money,” and they profit from the price difference.

For example, we can see that 4255 calls are expiring on March 17, and about 26,466 people are ” In the Money” @ $5. So, the strike price here is $5.

So, realistically 26,466 people have set the call at $5. So, if on the date on which the call option is expiring, i.e., March 17, the price of the AMC stock is more than $5; then these traders can exercise the call and buy the shares for $5 and sell it on March 17’s price and profit from the difference.

Let’s assume the price of AMC on March 17 is $6. Suppose trader A has set the call at $5 for 100 shares. So, on March 17, he can exercise the call and buy 100 AMC shares for $500 @$5 per share and sell at that day’s selling price @$6 per share for $600 and make a profit of $100.

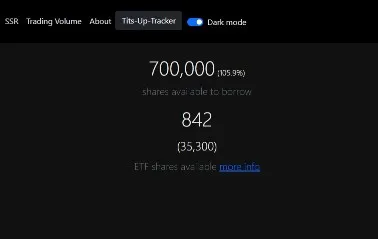

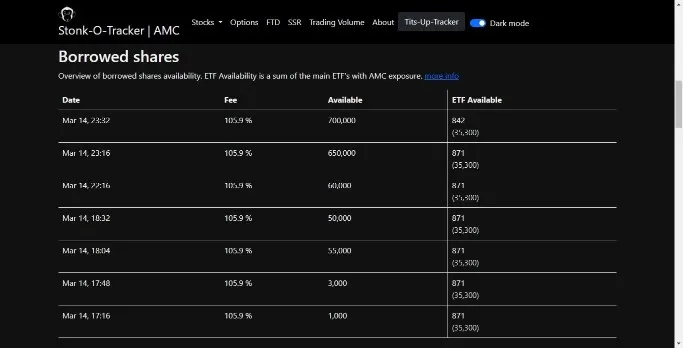

An important piece of information for short sellers is the number of shares of particular shares available to borrow.

So, in short selling, traders will borrow the shares from brokers. They will then short them and wait for the price to drop. Once the price drops, the traders will sell the shares back to the brokers and collect the gains due to the price difference.

Borrowing Shares varies according to the demand for the stock in the market, and so the number of available shares to borrow increases or decreases according to that demand. If the stock is shorted heavily, the availability number will dwindle, i.e., fewer stocks will be available to borrow.

The creator, however, notifies that this data is pulled from Interactive Brokers, so only the number of shares available to be borrowed from them doesn’t reflect the total number of shares available to be borrowed in the market.

AMC is part of some ETFs where it can be traded. It is also often used by short sellers to borrow shares. The ETF Shares Available indicate the number of shares in the ETF that short sellers can short.

The creator suggests using the table on the site for the detailed data. The latest table for AMC ETF shares data at the time of writing is as follows:

The above table gives a break-up of the shares available from the different ETFS. As you can see, SFYF has 833, and TWEB has 9 AMC shares to be borrowed.

Earlier, we discussed Call Option, Put Option, or Put is the same thing but in the opposite direction of the Call.

This table also indicates both ITM and OTM. OTM stands for Out of The Money, meaning that contracts be they Call or Put, are not near the stock’s current value.

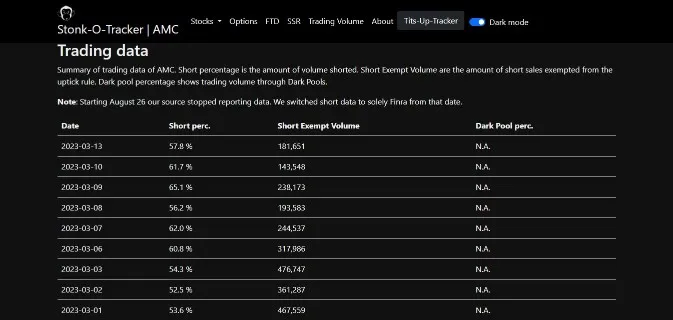

Short Percentage indicates the percentage of AMC shares of the total volume shorted in the stock market.

Dark Pool Percentage shows the percentage of short traders trading through Dark Pools that are not public and are most probably linked to dubious players trying to manipulate the stock price.

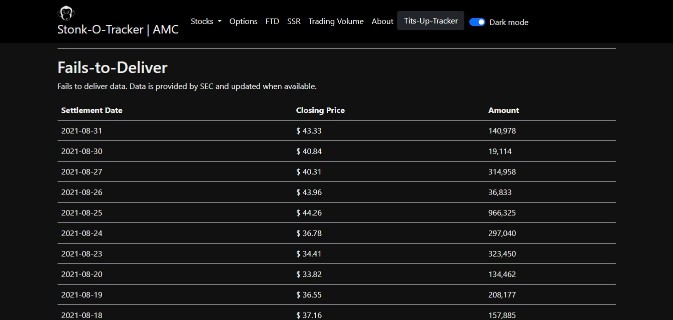

The following Fails to Deliver Chart includes the number of AMC shares that failed to execute, the date, and the closing price of the AMC share.

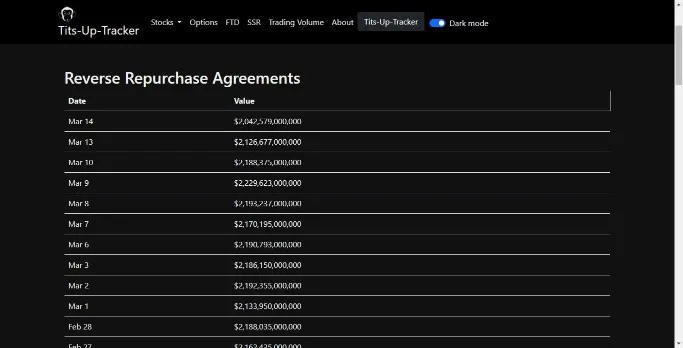

This tracker mainly tracks two different metrics:

The general assumption is that RRP indicates a lot of stress in the system and may lead to a crash in the economic system. However, the theory has been vehemently challenged by Bloomberg.

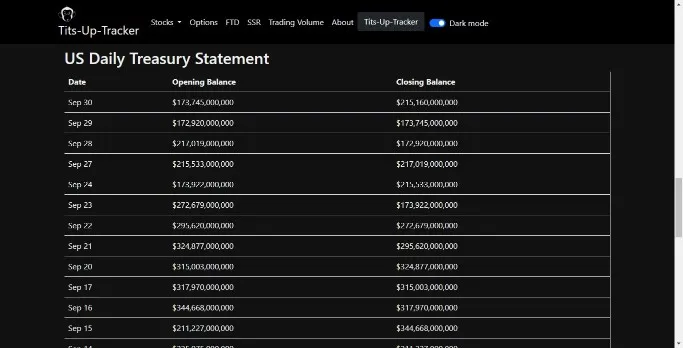

The US Treasury’s cash operations for the Federal Govt. on a modified cash basis are being portrayed in a tabular format in the US Daily Treasury Data. It includes the date, the opening, and the closing balance.

Also Read:

With more and more online companies foraying into the investment sector, it has become easier for retail investors to access the different modes of investments.

As a result of this mass adoption, many companies and their products have gained cult status, especially among amateur investors who would discuss them with much vigor and enthusiasm.

These stocks are often labeled as meme stocks and are mostly community driven. Two stocks that have become very popular in forums such as Reddit and Quora are AMC and GameStop.

However, the truth is that most of these meme stocks fade into oblivion as they don’t have any inherent value in them, and their price increase only due to the network effect of the community. AMC and GME are special because they are still thriving and have not been decimated despite being labeled as meme tokens.

AMC is a movie theater chain, and GameStop is a video game retailer. Both have one thing in common they have a strong connection with their loyal customers. So, the community fought back when several hedge funds bet against these two legacy companies and put huge short orders because of their outdated value proposition and the advent of online gaming and streaming services.

It was like the David vs. Goliath battle, where the retail investors were fighting for the existence of these two legacy brands and proving that the powerful large hedge funds could not defeat them out of their will.

It was then that the Stonk O Tracker was developed by an independent developer who loved those stocks to help potential traders with all the information on the internet in an organized manner on a website. Stonk is slang for Stocks that was first used in the subreddit r/wallstreetbets.

Also Read:

Stonk O Tracker is a nifty tool to track all the available information for AMC, GME, and BBBY stocks.

It provides all the necessary information, and one doesn’t need to scourge the internet for the info for both novice investors and experienced investors.

However, remember that although it provides benefits to investors, it should be taken with a pinch of salt as it might not be accurate, and more thorough research should be done to make investment decisions.

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by Stonk O Tracker. The product information may vary. Please check the company website for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any company. The content is for informational purposes only. It is not financial advice. So, before investing, do your due diligence and always invest what you are comfortable losing, as all investments are your responsibility.

Share this post:

Table of Contents Bloomberg once stated that the present-day economy relies heavily on the finance industry, vital support, and resource for businesses to flourish by

Table of Contents Looking to know more about the RMSL Stock? Wondering how they have performed and what are their prospects? The article addresses those

Table of Contents Rivian rose to prominence and garnered a lot of public attention in the automotive industry when it became the largest IPO or