Crypto Founder Tiantian Kullander & His Mysterious Death at Age 30

Table of Contents Tiantian Kullander, who co-founded the crypto company dealing with digital assets named Amber Group in Hong Kong, passed away in his sleep

The most significant advantage of PoS tokens is that they enable the users to earn a passive income by simply committing the tokens to be locked up for a minimum period. The users can withdraw after the minimum time limit or keep staking for a more extended period.

LUNC token, based on the PoS mechanism, also allows holders to earn a passive income by staking their tokens.

We will look at the process of staking the LUNC Token and multiple ways to stake LUNC tokens.

Let us now check how to stake LUNC through a detailed step-by-step process. It is as follows:

One needs to use a wallet for the process that supports the LUNC tokens. Earlier, the most popular choice was the Terra Station wallet, but now Terra Station has withdrawn support for the Luna Classic Network. Hence, we will choose the next best alternative.

We will be using the Atomic Wallet. The wallet supports both LUNA and LUNC, as well as Terra Networks.

So, download and install the atomic wallet app on your phone or desktop/laptop.

Open the Atomic Wallet, create an account, and safely store your 12-word seed phrase. It must be appropriately secured as digital wallets are decentralized, and they don’t have any mechanism to do a KYC for a customer. These seed phrases are the key to your wallet.

Create the account using a strong password but Don’t share the seed phrases with anyone.

Anyone with the key or seed phrases can access the Atomic wallet, the LUNC, or other tokens. It doesn’t matter if they know the password or not.

Any digital wallet allows users to recover their wallets with the help of the recovery phrase.

So, be extra vigilant.

Once the account is created, we need to fund our wallet. It can be done in two ways.

1. Buy any crypto in the atomic wallet and swap it to LUNC. Their swapping mechanism works in the same way as Terra swap, or Metamask works.

To do so, go to the navigation panel on the left and click “Exchange,” select from which token you will be converting to LUNC, and click on the “Exchange button” to complete the swap.

2. Buy LUNC from any other CEX, such as Binance, and transfer the tokens to the atomic wallet for staking.

We need to open the wallet and select LUNC to receive the tokens. Then click on “Receive.” Once we click on “Receive,” a page opens with a button called “Activate.”

Now, click “Activate,” and it will show the contract address for the LUNC tokens. Copy the address and go to the CEX, where you will send the LUNC tokens.

Paste the Deposit or Withdrawal address of the CEX, say Binance, and send the tokens to Atomic Wallet.

Once the LUNC tokens are deposited, we can start the Staking process.

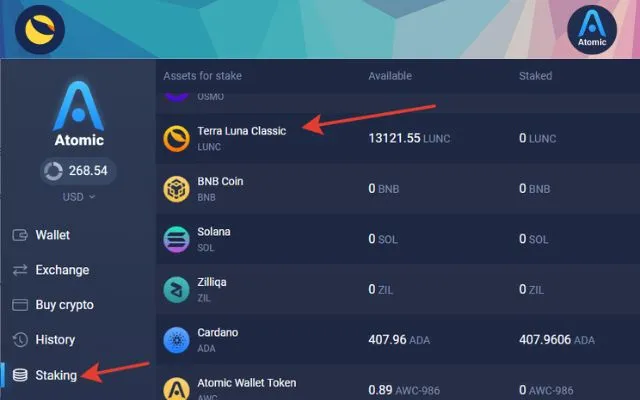

We need to head over to the left navigation panel and click on the option “Staking.”

It opens a page called “Stake and Earn” with a list of tokens available for staking. Select the LUNC token from the list.

Once you select the LUNC token, it opens a page with two buttons

It also shows the following information about your tokens:

There is also a legend available for all the terms. It can be accessed by clicking the “LUNC Staking Hints” button in the top right corner.

So, let’s check the two options in detail are:

1. Stake LUNC – This button will give you the option to stake your LUNC tokens

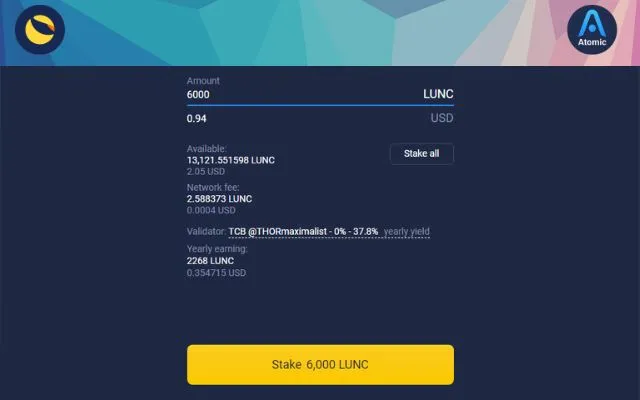

So, now we need to enter the amount of LUNC tokens we want to stake and select the Validator by clicking the “Validator” button.

We should choose a validator with a lower commission, allowing us to earn more staking rewards. However, sometimes validators with a lower commission might need to be more trustworthy.

It is a catch-22 situation, but consider different aspects before deciding.

A validator with a higher commission and high voting power may also ensure that the validator is reliable.

On the other hand, higher voting power for validators may lead to centralization and defeat the very purpose of decentralization. So, choosing a smaller validator with lower voting power will not only give higher rewards but will also ensure it provides a level playing field.

However, thorough research must be conducted before choosing the validator.

When writing this article, the only validator available in the Atomic Wallet is the Atomic Nodes Validator, which offers a hefty reward of 19%.

There may be more validators in the future.

2. Unstake – This option allows you to unstake or release the staked LUNC tokens

Note: LUNC Token Burning Mechanism

To reduce the supply and inflate the value of the LUNC token, they are burnt through their token-burning mechanism. For Terra Classic, 0.2% of the tokens involved are destroyed for every transaction to deplete the total supply of the tokens in circulation.

Some validators burn the commissions they receive to support the ecosystem and this burning mechanism. This community feeling still gives the holders the hope that Terra Luna will again reach the top ten ranking like in old times.

Now, after you have entered the amount of LUNC tokens to be staked and selected, the validator. We need to click on “Stake” and complete the staking process.

Tip: This is a small reminder not to stake all your available tokens, as a small network fee needs to be paid for the staking process with LUNC. So, keep some of the LUNC tokens for this purpose.

We must remember that we cannot simply click on “Unstake” and release the tokens immediately after they are staked. There is a mandatory waiting period where the tokens are locked for at least 21 days before they can be released.

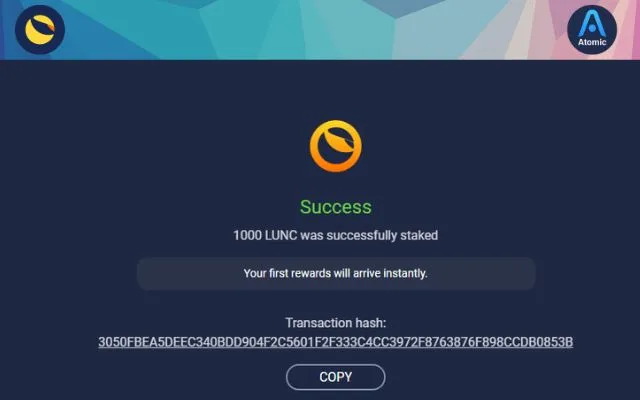

As soon as the process is complete, the LUNC tokens will be delegated to the validator chosen, marking the beginning of your staking journey.

You will receive the rewards in LUNC as per the contracts, and a portion of your earning will go to the validator for the block creation process that the validator will be doing.

At present, Atomic Wallet is offering annual rewards at 19%. It is by far the highest reward percentage in the market.

Remember that the rewards percentage may change depending on the on-chain value and the staked and unstaked LUNC ratio. Other network conditions may also affect the rewards earned.

Learn How To:

Terra Station was the native wallet of Terra’s blockchain network, but as Terra Station wallet doesn’t support Terra Classic Network anymore, let us look at the multiple other places where LUNC can be staked. We will be discussing two options here.

Kucoin launched LUNC staking on Feb 7, 2023. It offers an APR of 12% which may adjust as per the on-chain value

The Redemption period is 21 days, during which the tokens will be locked.

Apart from the staking rewards, Kucoin will also be paying out a daily mining reward called POL to its holders who have staked their LUNC tokens. The rewards will start generating after the staking period of 21 days.

Users can go to Kucoin Earn and start staking their tokens

The third option is to stake your LUNC tokens in one of the largest crypto exchanges in the world, Binance. It offers users to stake LUNC via the Flexible staking option.

However, compared to Kucoin and Atomic Wallet, it offers only an APR of 0.31%.

You can go to Binance and deposit LUNC tokens and lock them up for rewards through Binance’s earn option.

In the world of blockchain technology, one of the most critical factors that exist is the consensus mechanism.

The consensus mechanism is an algorithm that ensures that all the network terminals are correctly synchronized, and the transactions are valid.

There are eight consensus mechanisms, of which the two most popular ones are Proof of Work (PoW) and Proof of Stake (PoS).

Ecosystem Name | Terra |

Founder | Do Kwon |

Headquarter | Palo Alto, California, USA |

Year Founded | 2018 |

Mainnet Launch Year | 2019 |

Network | Terra Luna Classic, Terra |

Tokens |

|

Date of Launch | 1. Luna Classis, i.e., originally Luna – 2018 2. Luna or Luna 2.0 – 2022 3. UST – 2020 |

Consensus Mechanism of Terra | DPoS or Delegated Proof of Stake built on the Cosmos SDK |

Terra Projects | NFT, DeFi and Web 3.0 Applications |

Terra Classic is a cryptocurrency based on the PoS consensus mechanism. The native token of this staked proof-of-stake cryptocurrency is known as LUNC.

Terra (Luna) and the stablecoin UST used to be two of the largest cryptocurrencies till 2022. But then the May crash happened, and the value of the tokens went close to zero.

Millions of users lost billions of dollars in a single week.

The founder, Do Kwon, formulated a plan to revive the coins. A new token called Luna 2.0 or Luna was launched. The previous token was renamed Luna Classic or LUNC. Both these tokens can co-exist at the same time.

It is a community-driven coin where the members are loyal to the token LUNC and actively working to reestablish the lost stature in the Terra Luna and UST fiasco. They are continuously supporting the ecosystem through staking LUNC.

The PoS mechanism is designed to select the validators who can create a block randomly.

Token holders can become validators by staking the LUNC token. They lock the tokens for a specified time, allowing them to create blocks.

Usually, incentives for validators are collected as a portion of the transaction fees. It is also possible for validators to gain more coins if there is inflation.

So, the validators are rewarded so that they keep the blockchain and the network operational. The higher the stake, the higher the rewards.

As compared to other mechanisms, PoS is also much more energy efficient.

Trust Wallet does not allow LUNC staking. You can only stake Luna in trust wallet

To stake Luna:

Yes, LUNC can be staked to earn yearly APY rewards. Many CEXs and Crypto Wallets offer the staking function for LUNC. They offer rewards ranging from 0.3% to 19% annually.

There are multiple options to stake Terra Classic’s LUNC tokens.

In CEXs, you can stake with

In terms of Software and Hardware Wallets

The benefit of staking LUNC tokens is to earn a passive income. It offers APY interest on the tokens during their lock-up period. It also helps the entire Terra Ecosystem function and supports the burning mechanism. Because of staking, validators are making money through transaction fees, and as a result, blocks are getting created, and the holders are also earning a handsome reward.

Due to macro market conditions and the epic collapse of Luna and their algorithmic stablecoin UST in 2022, it has lost almost all its value. Although 2023 has seen some positive growth after the V22 upgrade and offers an excellent staking reward, it still has a long way to go. The transaction volume is also low. For new users, it is advisable to avoid this digital asset at the moment.

Read More:

Given the current situation that Terra Luna and UST went through, this at least provides some hope for the token holders. The process may be challenging, but at least it’s working towards a positive goal.

Some important aspects to be taken care of are:

Disclaimer: All the information presented in the article has been collected independently by BitMoneyAlpha and has not been reviewed or approved by LUNC or Luna Coin. The product information may vary. Please check the issuer’s websites for the latest information. The statements and opinions expressed in this article belong to the author and do not necessarily represent the views or opinions of any cryptocurrency issuer. The content is for informational purposes only. It is not financial advice. So, before buying LUNC, do your due diligence and always invest what you are comfortable losing, as all investments are your responsibility.

Also Read :

Share this post:

Table of Contents Tiantian Kullander, who co-founded the crypto company dealing with digital assets named Amber Group in Hong Kong, passed away in his sleep

Table of Contents The Bulgarian owner of the crypto exchange RG Coin was sentenced to 10 years of imprisonment. He was convicted on the charges

Table of Contents The crypto industry has seen the worst of its days in 2022. At first, there was a slew of collapses of some